Significant HSA Contribution Limit Increase for 2024

By Brian Gilmore | Published May 23, 2023

Executive Summary

The IRS has issued its annual inflation adjustment to the HSA contribution limits for calendar year 2024. With inflation still at high levels, we will have a second consecutive year of unusually large increases to the HSA contribution limits.

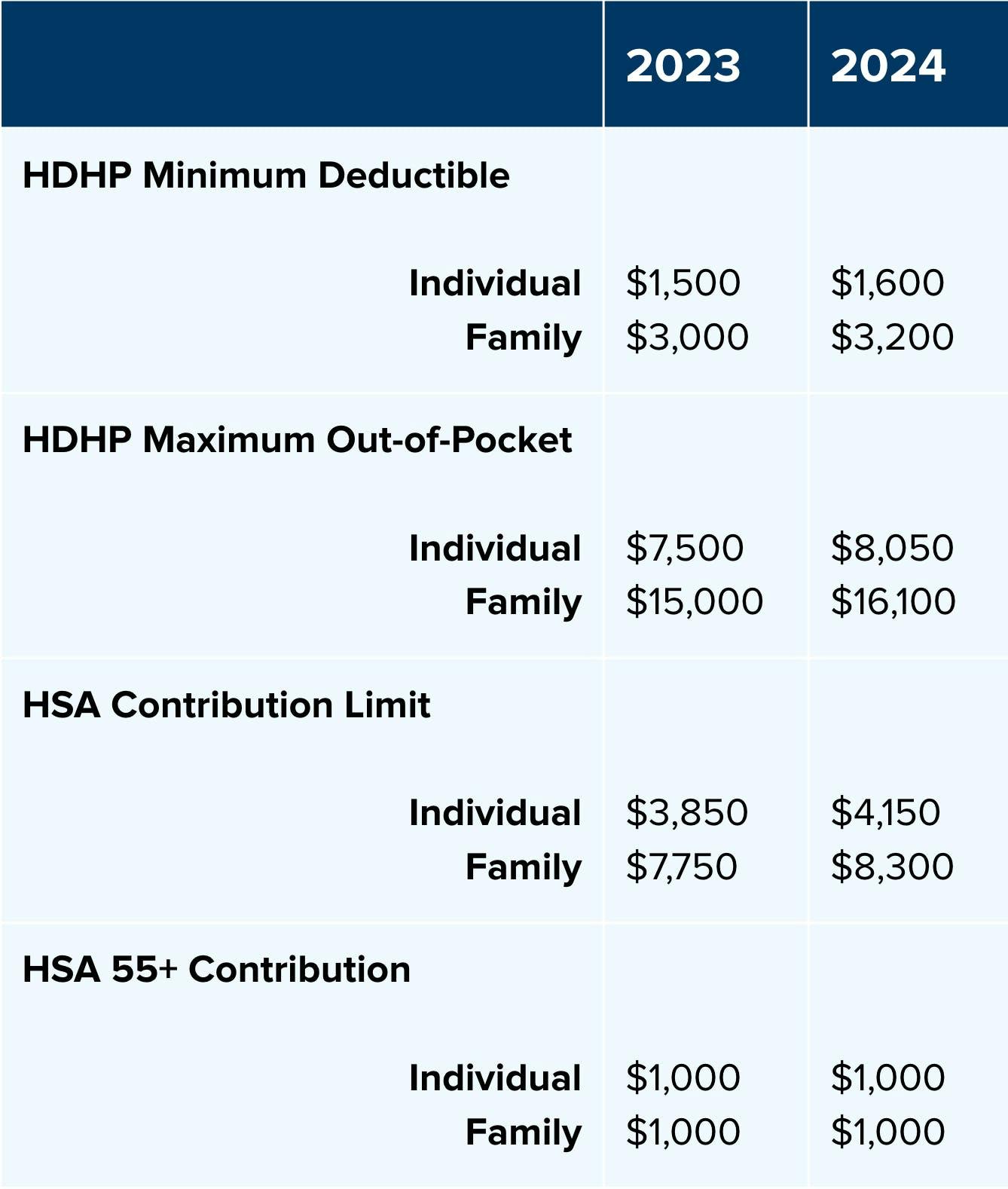

The 2024 HSA contribution limits are as follows:

Individual Coverage: $4,150 ($300 increase)

Family Coverage: $8,300 ($550 increase)

2024 Inflation Adjusted Amounts for HSAs and HDHPs

The IRS issues annual updates announcing HSA contribution limit increases. The cost-of-living adjustments are based on the Chained Consumer Price Index for All Urban Consumers (C-CPI-U).

The full guidance for the 2024 HSA limit increases is available here:

Although inflation is trending downward now, it was still much higher than normal last year (7%-8% generally) and responsible for a second consecutive unusually large HSA contribution limit increase. The result is a $300 and $550 increase to the 2024 individual and family coverage HSA contribution limits, respectively.

The 2024 calendar year HSA contribution limits are as follows:

The 2024 HSA contribution limit for individual coverage increases by $300 to $4,150.

The 2024 HSA contribution limit for family coverage (employee plus at least one other covered individual) increases by $550 to $8,300.

Note: The age 55+ catch-up contribution limit of $1,000 is fixed by law and does not adjust for inflation.

The annual IRS update also includes the 2024 calendar year minimum deductible and out-of-pocket maximums allowed for a plan to qualify as a high deductible health plan (HDHP)—the required coverage for an individual to be eligible to make or receive HSA contributions.

The 2024 HDHP inflation adjusted amounts are as follows:

The 2024 minimum deductible for individual coverage increases by $100 to $1,600.

The 2024 minimum deductible for family coverage increases by $200 to $3,200.

The 2024 maximum out-of-pocket limit for individual coverage increases by $550 to $8,050.

The 2024 maximum out-of-pocket limit for family coverage will increase by $1,100 to $16,100.

Note: In family HDHP coverage, any embedded individual deductible cannot be lower than the minimum family coverage deductible ($3,200 in 2024).

Table of 2024 Inflation Adjusted HSA Amounts

Additional HSA Updates

HSAs have experienced a whirlwind of enhancements in recent years. Although none of the changes by themselves are revolutionary, the modifications are significant in the aggregate. Taken together, these changes have noticeably improved HDHPs and HSAs by increasing reimbursable expenses and eliminating unnecessary barriers to eligibility:

First-Dollar Telehealth Relief (extension effective PYs beginning after 12/31/22 and before 1/1/25)

CAA 2023 extended for a second time CARES Act and CAA 2022 relief to provide that HDHPs can provide first-dollar telehealth and other remote care services for the 2023 and 2024 plan years.

No Surprises Act (effective for plan years beginning on or after January 1, 2022)

HSA eligibility and HDHP status is not affected by surprise billing benefits made under the CAA’s No Surprises Act provisions (or similar state law protections).

Full details: CAA Surprise Billing Rules Preserve HSA Eligibility

Personal Protective Equipment (effective for expenses incurred on or after January 1, 2020)

HSAs (and FSAs and HRAs) may reimburse PPE such as masks, hand sanitizer, and sanitizing wipes for the primary purpose of preventing the spread of Covid.

Menstrual Care Products (effective for expenses incurred on or after January 1, 2020)

HSAs (and FSAs and HRAs) may reimburse menstrual care products—including tampons, pads, liners, cups, sponges, or other similar products.

Full details: How the CARES Act Affects Employee Benefits

Over-the-Counter Medicines and Drugs (effective for expenses incurred on or after January 1, 2020)

HSAs (and FSAs and HRAs) may reimburse over-the-counter medicines and drugs without the need for a prescription.

Full details: How the CARES Act Affects Employee Benefits

Free Covid Testing (effective March 2020)

Plans will not fail to maintain HDHP status if they provide first-dollar coverage for medical care services and items purchased related to testing for and treatment of Covid.

Expansion of Preventive Care Services (effective July 2019)

Expansion of HDHP first-dollar coverage availability to include medical services and items to prevent exacerbation of a chronic condition.

Full details: IRS Expands Definition of Preventive Care for HDHPs

For more details on everything HDHP/HSA, see our Newfront Go All the Way With HSA Guide.

Disclaimer: The intent of this analysis is to provide the recipient with general information regarding the status of, and/or potential concerns related to, the recipient’s current employee benefits issues. This analysis does not necessarily fully address the recipient’s specific issue, and it should not be construed as, nor is it intended to provide, legal advice. Furthermore, this message does not establish an attorney-client relationship. Questions regarding specific issues should be addressed to the person(s) who provide legal advice to the recipient regarding employee benefits issues (e.g., the recipient’s general counsel or an attorney hired by the recipient who specializes in employee benefits law).

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn