How COBRA and Medicare Interact for Retirees

By Brian Gilmore | Published June 12, 2020

**Question: **What are the main considerations for retiring employees regarding how COBRA and Medicare interact?

**Short Answer_:_ **There are four primary issues for Medicare-eligible employees to consider upon deciding if and when to elect COBRA after terminating employment.

Issue #1: Medicare Will Pay Primary (COBRA Coverage Can Assume Primary Medicare Payment Even If Not Enrolled)

In general, the Medicare Secondary Payer (MSP) rules require that the employer-sponsored group health plan always pay primary to Medicare for individuals in “current employment status.” This means for any active employee or spouse (but not domestic partner), Medicare will pay secondary.

For full details on when the MSP rules apply, see our previous post: Medicare Secondary Payer Employer Size Requirements.

However, retirees enrolled in COBRA (or an employer-sponsored plan for retirees) are not receiving employer-sponsored coverage based on “current employment status.” In other words, they are not in active coverage. This means that Medicare pays primary for anyone enrolled in COBRA.

In the COBRA context where the MSP rules do not apply and Medicare is primary, the plan can assume the Medicare payment rate and pay only as secondary coverage for any individual who is eligible for COBRA. This is true regardless of whether the individual is actually enrolled in Medicare.

For example, if an individual’s services would have been covered primary by Medicare if the participant were enrolled in Part B, the carrier can pay only the amount that a secondary plan would pay. For individuals not enrolled in Part B, that leaves the amount that would have been paid by Part B as a coverage gap for which the participant is responsible.

Medicare-eligible retirees will never want to be in a position where they fail to enroll in Medicare while enrolled in COBRA under a plan that assumes the Medicare primary payment rate regardless of actual Medicare enrollment.

The recently updated DOL model COBRA initial notice and model COBRA election notice include a provision directly addressing this issue:

If you are enrolled in both COBRA continuation coverage and Medicare, Medicare will generally pay first (primary payer) and COBRA will pay second. Certain COBRA continuation coverage plans may pay as if secondary to Medicare, even if you are not enrolled in Medicare.

Issue #2: The Eight-Month Medicare Special Enrollment Period is Not Extended by COBRA Enrollment

Medicare-eligible employees are eligible for an eight-month Medicare special enrollment period upon retirement (or any termination of employment) that begins upon the earlier of:

The month after employment ends; or

The month after active coverage ends.

COBRA coverage (including subsidized COBRA) does not extend the start date of this eight-month special enrollment period. In other words, the eight-month Medicare special enrollment period will begin to run regardless of whether the employee elects COBRA.

Medicare-eligible employees who fail to enroll in Medicare during the eight-month special enrollment period can enroll in Part B only during the January 1 – March 31 General Enrollment Period for coverage effective as of the following July 1.

The recently updated DOL model COBRA initial notice and model COBRA election notice include a provision directly addressing this issue:

In general, if you don’t enroll in Medicare Part A or B when you are first eligible because you are still employed, after the initial enrollment period for Medicare Part A or B, you have an 8-month special enrollment period to sign up, beginning on the earlier of:

The month after your employment ends; or

The month after group health plan coverage based on current employment ends.

For more details:

Employee-Facing Medicare Summary: Newfront Medicare Resources Guide for Employees

Issue #3: COBRA Does Not Qualify to Avoid Part B Late Enrollment Penalties

Retiring employees have eight months to sign up for Medicare Part B without a penalty. That eight-month period to enroll in Part B applies regardless of whether the employee elects COBRA.

Failure to enroll in Part B during the eight-month special enrollment period after losing active coverage will result in a late enrollment penalty of up to 10% for each full 12-month period late. In most cases, this late enrollment penalty increase to the Part B premium will remain in effect for as long as the individual maintains Part B coverage.

Retiring Medicare-eligible employees generally should not wait to enroll in Medicare Part B until they have exhausted (or no longer want) COBRA coverage. Failure to enroll in Part B during the eight-month Medicare special enrollment period will result in:

A late enrollment penalty for as long as the individuals has Part B; and

The inability to enroll in Part B until January 1 – March 31, and the individual will have to wait until July 1 of that year before coverage begins (which may cause a significant coverage gap).

The recently updated DOL model COBRA initial notice and model COBRA election notice include a provision directly addressing this issue:

If you don’t enroll in Medicare Part B and elect COBRA continuation coverage instead, you may have to pay a Part B late enrollment penalty and you may have a gap in coverage if you decide you want Part B later.

For more details:

Medicare Summary for Employers: Newfront Office Hours Webinar: Medicare for Employers

Employee-Facing Medicare Summary: Newfront Medicare Resources Guide for Employees

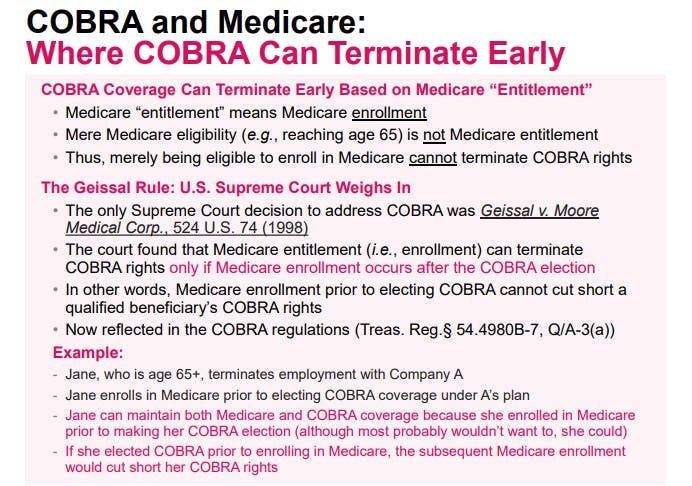

Issue #4: Early Termination of COBRA Upon Enrollment in Medicare

COBRA can terminate early if the qualified beneficiary enrolls in Medicare after electing COBRA.

There are a few key points with this rule:

Mere eligibility for Medicare (e.g., reaching age 65) does not affect COBRA rights.

Although the COBRA rules refer to Medicare “entitlement,” guidance confirms that “entitlement” means “enrollment.”

The enrollment in Medicare must occur after the qualified beneficiary elected COBRA to cause early termination.

The timing piece means that a qualified beneficiary who enrolled in Medicare prior to electing COBRA will not be subject to early termination of COBRA because of the Medicare enrollment. In other words, qualified beneficiaries who want to have Medicare and remain on COBRA must be careful to enroll in Medicare prior to electing COBRA.

This timing rule stems from the 1998 U.S. Supreme Court case Geissal v. Moore Med. Corp., which is the only U.S. Supreme Court case to address COBRA rights. Since the U.S. Supreme Court’s ruling, the IRS has updated the COBRA regulations to confirm that only enrollment in Medicare after electing COBRA can cut short the qualified beneficiary’s COBRA rights (Treas. Reg. §54.4980B-7, Q/A-3).

The recently updated DOL model COBRA initial notice and model COBRA election notice include a provision directly addressing this issue:

If you elect COBRA continuation coverage and then enroll in Medicare Part A or B before the COBRA continuation coverage ends, the Plan may terminate your continuation coverage. However, if Medicare Part A or B is effective on or before the date of the COBRA election, COBRA coverage may not be discontinued on account of Medicare entitlement, even if you enroll in the other part of Medicare after the date of the election of COBRA coverage.

For more details, see our previous post: Early Termination of COBRA Upon Enrollment in Medicare.

Note that the Cal-COBRA rules are the same except for one major difference: Cal-COBRA provides that mere Medicare eligibility (as opposed to enrollment) will cut Cal-COBRA rights short.

Regulations

42 USC §1395y(b)(1)(A)(i)(l):

(b) Medicare as secondary payer.

_(1) _Requirements of group health plans.

(A) Working aged under group health plans.

(i) In general. A group health plan—

(I) may not take into account that an individual (or the individual’s spouse) who is covered under the plan by virtue of the individual’s current employment status with an employer is entitled to benefits under this subchapter under section 426(a) of this title, and

(II) shall provide that any individual age 65 or older (and the spouse age 65 or older of any individual) who has current employment status with an employer shall be entitled to the same benefits under the plan under the same conditions as any such individual (or spouse) under age 65.

HHS Letter Addressing Non-Application of the MSP Rules to COBRA Coverage:

http://www.americanbar.org/content/dam/aba/migrated/jceb/2002/0205hhs_ltr.authcheckdam.pdf

Answer: For individuals who are entitled to Medicare on the basis of age or disability Medicare is the secondary payer due to the individual’s “current employment status.” COBRA benefits are provided where the individual would otherwise lose coverage under the employer’s group health plan (GHP) because of certain “qualifying events.” These include termination of employment (other than for gross misconduct) and reduction of hours of employment. Since COBRA coverage is provided pursuant to the COBRA statute, rather than “by virtue of current employment status” Medicare is the primary payer for the working aged and disabled who are enrolled in the GHP as a result of COBRA coverage.

Treas. Reg. §54.4980B-7, Q/A-3:

**Q-.3. **When may a plan terminate a qualified beneficiary’s COBRA continuation coverage due to the qualified beneficiary’s entitlement to Medicare benefits?

**A-3. **(a) If a qualified beneficiary first becomes entitled to Medicare benefits under Title XVIII of the Social Security Act (42 U.S.C. 1395-1395ggg) after the date on which COBRA continuation coverage is elected for the qualified beneficiary, then the plan may terminate the qualified beneficiary’s COBRA continuation coverage upon the date on which the qualified beneficiary becomes so entitled. By contrast, if a qualified beneficiary first becomes entitled to Medicare benefits on or before the date that COBRA continuation coverage is elected, then the qualified beneficiary’s entitlement to Medicare benefits cannot be a basis for terminating the qualified beneficiary’s COBRA continuation coverage.

(b) A qualified beneficiary becomes entitled to Medicare benefits upon the effective date of enrollment in either part A or B, whichever occurs earlier. Thus, merely being eligible to enroll in Medicare does not constitute being entitled to Medicare benefits.

Geissal v. Moore. Med. Corp., 524 U.S. 74 (1998):

Moore’s reading, however, will not square with the text. Subsection 1162(2)(D)(i) does not provide that the employer is excused if the beneficiary “is” covered or “remains” covered on or after the date of the election. Nothing in § 1162(2)(D)(i) says anything about the hierarchy of policy obligations, or otherwise suggests that it might matter whether the coverage of another group health plan is primary. So far as this case is concerned, what is crucial is that § 1162(2)(D)(i) does not speak in terms of “coverage” that might exist or continue; it speaks in terms of an event, the event of “becoming covered.” This event is significant only if it occurs, and “first” occurs, at a time “after the date of the election.” It is undisputed that both before and after James Geissal elected COBRA continuation coverage he was continuously a beneficiary of TWA’s group health plan. Because he was thus covered before he made his COBRA election, and so did not “first become” covered under the TWA plan after the date of election, Moore could not cut off his COBRA coverage under the plain meaning of § 1162(2)(D)(i).

California Insurance Code §10128.52(a):

The continuation coverage requirements of this article do not apply to the following individuals:

(a) Individuals who are entitled to Medicare benefits or become entitled to Medicare benefits pursuant to Title XVIII of the United States Social Security Act, as amended or superseded. Entitlement to Medicare Part A only constitutes entitlement to benefits under Medicare.

California DMHC Cal-COBRA Overview:

https://www.dmhc.ca.gov/HealthCareinCalifornia/TypesofPlans/KeepYourHealthCoverage(COBRA).aspx

Why would an employee not qualify to enroll in Cal-COBRA?

The employee is enrolled in or eligible for Medicare.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn