Medicare Secondary Payer Employer Size Requirements

By Brian Gilmore | Published October 25, 2019

**Question: **At what size are employers subject to the Medicare Secondary Payer rules?

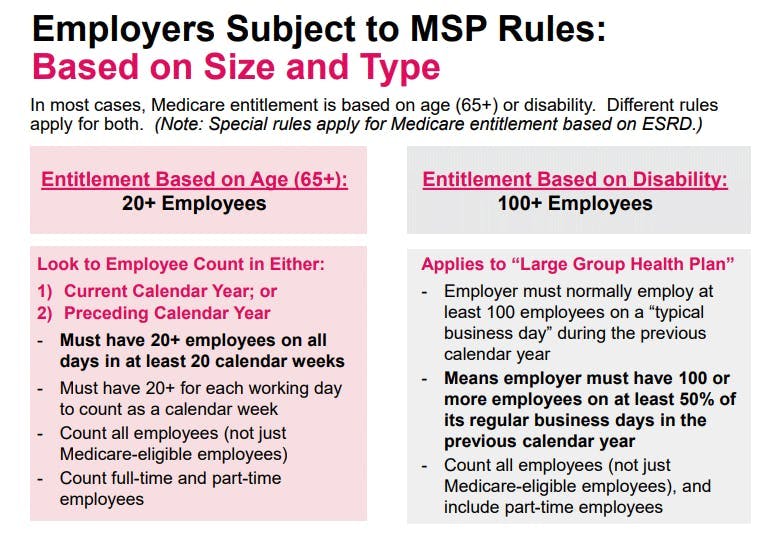

**Short Answer: **The Medicare Secondary Payer rules generally apply at 20 employees for Medicare entitlement based on age, and 100 employees for Medicare entitlement based on disability.

Medicare Secondary Payer Rules: General Rule

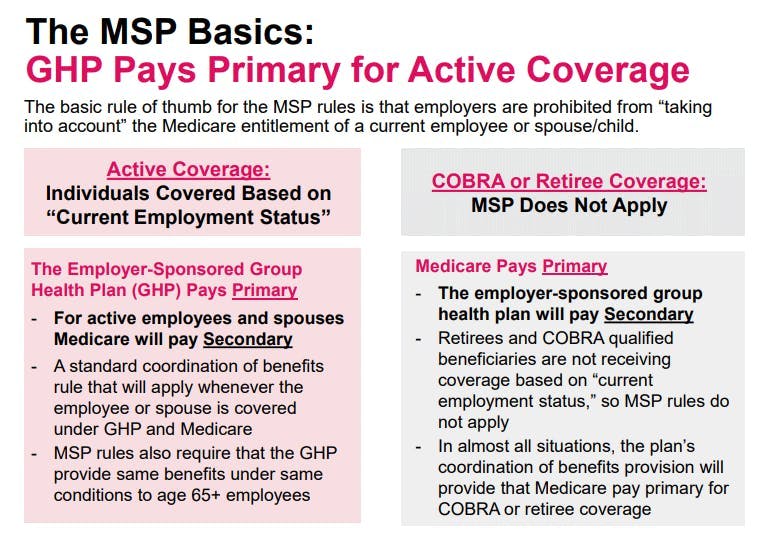

The Medicare Secondary Payer (MSP) rules prohibit employer-sponsored group health plans from taking into account the Medicare enrollment of a current employee or a current employee’s spouse or family member.

There are a number of basic rules that flow from this general principle, including:

For any active employee or family member covered by the employer-sponsored group health plan and Medicare, the employer-sponsored group health plan pays primary.

The employer-sponsored group health plan must provide the same benefits under the same conditions to employees and family members who are Medicare-eligible.

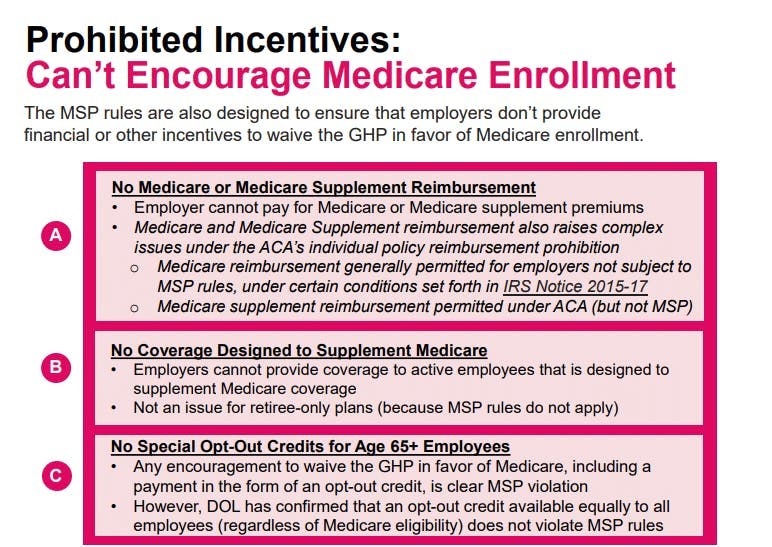

The MSP rules prohibit offering employees or family members eligible for Medicare any financial or other incentives to opt-out of the employer-sponsored group health plan.

Medicare Secondary Payer Rules Apply at Different Thresholds Depending on Type of Medicare Entitlement

The MSP rules apply to different employer sizes depending on whether the individual is entitled to Medicare based on age or disability.

Each threshold is described below. Note that a third set of even more complex rules applies for Medicare entitlement based on End Stage Renal Disease (ESRD), which is not addressed in this post.

Employers Subject to Medicare Secondary Payer Rules Based on Age: 20+ Employees

**The Medicare Secondary Payer rules for Medicare entitlement based on age (i.e., reaching age 65) apply to employers with 20 or more employees for each working day for at least 20 calendar weeks in either the current or preceding calendar year. **

A few additional clarifying notes:

The employee count includes all employees regardless of Medicare eligibility.

The employee count includes full-time and part-time employees.

An employee does not have to work on a particular day to be considered an employee.

Where the employer becomes subject to the MSP rules based on the current-year employee count for at least 20 calendar weeks, the MSP rules will apply immediately and through the subsequent calendar year.

If an employer drops below 20 employees while subject to the MSP rules, it will remain subject to the MSP rules through at least the remainder of current calendar year.

Employers Subject to Medicare Secondary Payer Based on Disability: 100+ Employees

The Medicare Secondary Payer rules for Medicare entitlement based on disability apply to employers that normally employed at least 100 employees on a typical business day during the previous calendar year.

The technical definition in the rules provides that the MSP rules based on disability entitlement apply to “large group health plans.” The MSP rules define a “large group health plan” as existing where the employer normally employed at least 100 employees (full-time or part-time) on 50% or more of its regular business days during the previous calendar year. All employees are counted, regardless of group health plan enrollment or Medicare eligibility.

Regulations

42 U.S.C. §1395y(b)(1)(A):

(b) Medicare as secondary payer.

_(1) _Requirements of group health plans.

(A) Working aged under group health plans.

(i) In general. A group health plan—

(I) may not take into account that an individual (or the individual’s spouse) who is covered under the plan by virtue of the individual’s current employment status with an employer is entitled to benefits under this subchapter under section 426(a) of this title, and

(II) shall provide that any individual age 65 or older (and the spouse age 65 or older of any individual) who has current employment status with an employer shall be entitled to the same benefits under the plan under the same conditions as any such individual (or spouse) under age 65.

(ii) Exclusion of group health plan of a small employer. Clause (i) shall not apply to a group health plan unless the plan is a plan of, or contributed to by, an employer that has 20 or more employees for each working day in each of 20 or more calendar weeks in the current calendar year or the preceding calendar year.

42 U.S.C. §1395y(b)(1)(B):

B) Disabled individuals in large group health plans.

(i) In general. A large group health plan (as defined in clause (iii)) may not take into account that an individual (or a member of the individual’s family) who is covered under the plan by virtue of the individual’s current employment status with an employer is entitled to benefits under this subchapter under section 426(b) of this title.

(ii) Exception for individuals with end stage renal disease. Subparagraph (C) shall apply instead of clause (i) to an item or service furnished in a month to an individual if for the month the individual is, or (without regard to entitlement under section 426 of this title) would upon application be, entitled to benefits under section 426-1 of this title.

(iii) “Large group health plan” defined. In this subparagraph, the term “large group health plan” has the meaning given such term in section 5000(b)(2) of the Internal Revenue Code of 1986, without regard to section 5000(d) of such Code.

IRC §5000(b)(2):

(2) Large group health plan.

The term “large group health plan” means a plan of, or contributed to by, an employer or employee organization (including a self-insured plan) to provide health care (directly or otherwise) to the employees, former employees, the employer, others associated or formerly associated with the employer in a business relationship, or their families, that covers employees of at least one employer that normally employed at least 100 employees on a typical business day during the previous calendar year. For purposes of the preceding sentence—

(A) all employers treated as a single employer under subsection (a) or (b) of section 52 shall be treated as a single employer,

(B) all employees of the members of an affiliated service group (as defined in section 414(m)) shall be treated as employed by a single employer, and

(C) leased employees (as defined in section 414(n)(2)) shall be treated as employees of the person for whom they perform services to the extent they are so treated under section 414(n).

42 CFR §411.101

Large group health plan (LGHP) means a GHP that covers employees of either—

(1) A single employer or employee organization that employed at least 100 full-time or part-time employees on 50 percent or more of its regular business days during the previous calendar year; or

(2) Two or more employers, or employee organizations, at least one of which employed at least 100 full-time or part-time employees on 50 percent or more of its regular business days during the previous calendar year.

CMS Medicare Secondary Payer (MSP) Manual:

http://www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/Downloads/msp105c02.pdf

10.3 – The 20-or-More Employees Requirement

(Rev. 1, 10-01-03)

The working aged MSP provision applies only to GHPs of employers with 20 or more employees and to multi-employer and multiple employer GHPs in which at least one employer employs 20 or more employees. This requirement is met if an employer has 20 or more full-time and/or part-time employees for each working day in each of 20 or more calendar weeks in the current or preceding year. An employer is considered to have 20 or more employees for each working day of a particular week if the employer has at least 20 full-time or part-time employees on its employment rolls each working day of that week. This condition is met as long as the total number of individuals on the employer’s rolls adds up to at least 20 regardless of the number of employees who work or who are expected to report for work on a particular day. Self-employed individuals participating in a GHP are not counted as employees for purposes of determining if the 20-or-more employee requirement is met. An individual is considered to be on the employment rolls even if the employee does not work on a particular day. An employer may not have different employment rolls for different days reflecting those scheduled.

Where an employer does not have 20 or more employees in the preceding year, it is required to offer its employees and spouses age 65 or over primary coverage beginning with the point in time at which the employer has had 20 or more employees on each working day of 20 calendar weeks of the current year. The employer is then required to offer primary coverage for the remainder of that year and throughout the following year even if the number of employees drops below 20 after the employer has met the requirement.

The 20-or-more employees requirement must be met at the time the individual receives the services for which Medicare benefits are claimed. If at that time the employer has met the 20-or- more employees requirement in the current year or in the preceding calendar year, the GHP is primary payer. An employer that meets this requirement must provide primary coverage even if less than 20 employees participate in the GHP. (See Chapter 1, §60, for determining the size of employers.)

…

(Rev. 1, 10-01-03)

Medicare is secondary payer to “large group health plans” (LGHPs) for individuals under age 65 entitled to Medicare on the basis of disability and whose LGHP coverage is based on the individual’s current employment status or the current employment status of a family member. (See Chapter 1, §50, for definition.) Under the law, a LGHP may not “take into account” that such an individual is eligible for, or receives, Medicare benefits based on disability. Apply the instructions in chapter 1 in processing claims where Medicare is secondary payer for disabled individuals. Where those sections refer to a GHP of 20 or more employees, substitute the term “large group health plan” as defined in Chapter 1, §20, to apply them to disabled individuals.

Medicare is secondary payer to LGHP coverage based on an individual’s or family members current employment status for services provided on or after August 10, 1993.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn