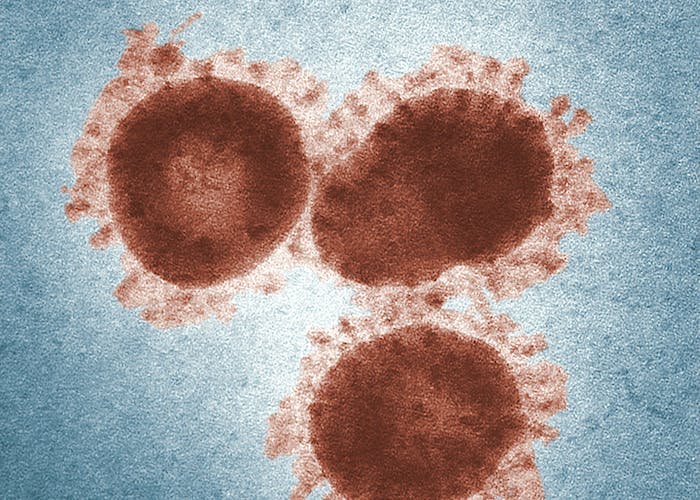

Insurance and COVID-19: Ongoing News Coverage

By Anna Beach | Published March 18, 2020

At Newfront, we are closely monitoring developments at the intersection of insurance and COVID-19. We're actively engaging with our clients to help them bolster their finances during this time of crisis, understand their coverages, and stay informed about whether any coronavirus-related claims might be covered. To keep our clients up to date, we've published a COVID-19 resource hub and are hosting a "Real Talk for Businesses" webinar on Thursday, March 26 to answer many of your questions surrounding coronavirus and insurance.

Here, we're sharing a list of news articles tracking the debate surrounding business interruption coverage due to coronavirus. Bookmark this page and check back; we will update this list as development occur.

Insurers Reject House Members’ Request to Cover Uninsured COVID Business LossesMarch 20, Insurance Journal

"A bipartisan group of U.S. House members has asked insurers to retroactively recognize financial losses relating to COVID-19 under commercial business interruption coverage for policyholders."

Proposed N.J. Bill Would Require Insurers to Pay COVID-19 Business Interruption ClaimsMarch 19, Insurance Journal

"A proposed New Jersey bill, which aims to create business interruption insurance coverage for COVID-19 related claims despite virus exclusions in many policies, has drawn concern about the constitutionality of legislation like this."

Coronavirus Coverage Tied to Physical Damage Definition: ExpertsMarch 16, Business Insurance

“Open questions about coverage surrounding the coronavirus may well turn on the definition of physical damage and whether the virus or its presence meets that threshold, legal experts say.”

French Quarter Restaurant Sues in What May Be First U.S. Coronavirus Insurance DisputeMarch 16, WWL-TV New Orleans

“In what’s believed to be a first in the U.S., a French Quarter restaurant is suing Lloyd’s of London, hoping a judge will order the U.K. based insurance market to cover losses caused by government-ordered closures due to the coronavirus.”

Coronavirus Losses and Insurance PoliciesMarch 13, National Law Review

“As companies look to mitigate coronavirus-related losses, they should carefully review their insurance policies to determine whether they provide coverage for losses. While coverage will ultimately turn on the specific terms of the relevant insurance policies and the precise nature of the losses, a number of insurance lines may provide relief.”

Coronavirus Work-from-Home Response May Expand Cyber RiskMarch 13, Insurance Journal

“As U.S. employers ask employees to work from home to avoid exposure to coronavirus, they may be exposing themselves to another kind of risk: Cyberattacks.”

Insurers Face Big Investment Losses, Trade Credit Claims from Coronavirus CrisisMarch 12, Insurance Journal

“Having initially brushed off the potential impact from coronavirus-linked claims, global insurers are waking up to the prospect of a double whammy – a sharp rise in payouts at a time of big investment losses.”

Risk Managers Advised to Prepare for Coronavirus D&O ClaimsMarch 10, Business Insurance

“Businesses should brace themselves for a likely flood of shareholder suits related to the new coronavirus outbreak, but the success of any litigation may depend on companies’ willingness to fully disclose directors and officers liability-related risks now, say many experts.”

Will Business Interruption Insurance Provide Coverage for Coronavirus Losses?March 6, Stroock & Stroock & Lavan LLP

"With COVID-19 disrupting global supply chains and sales, businesses are losing income and incurring additional expenses as a result of the disruption. Whether the claims are covered will depend on the terms and conditions of the insurance policy and the circumstances of the loss."

Lawsuits Against Businesses Over Coronavirus Have Begun. More to Come?March 4, Insurance Journal

"The coronavirus has upended markets, disrupted supply chains and forced quarantines. It’s all fertile ground for lawsuits. Here’s a survey of the likely legal landscape."

Anna Beach

Chief Insurance Officer

Anna Beach is the Chief Insurance Officer for Newfront Insurance. She has worked in insurance for 28 years and across a wide variety of roles, which has given her a comprehensive view of the industry, its problems, and the potential to make dramatic improvements. Anna is responsible for ensuring quality control and internal risk management, maximizing our carrier and vendor partnerships, and solving complex insurance related matters.

Connect on LinkedIn