Top D&O Market and Claims Trends for 2022

By Newfront | Published April 11, 2022

Public, private, and nonprofit companies have one thing in common: they all face Director and Officer (D&O) litigation risks. Obtaining coverage for your clients is as important as ever, especially in this heightened litigious environment, as coverage protects executives, board members, their spouses, and the company.

Earlier this month, Newfront’s Deirdre Finn, Executive Vice President of Executive Risk Solutions, Eric Tausend, Senior Vice President of Executive Risk Solutions, and Dereick Wood, Senior Vice president of National Claims Services and Client Engagement, were joined by Industry Experts Kevin LaCroix, Esq., Executive Vice President, RT Pro Exec and Author of the D&O Diary, and Marissa Streckfus, Esq., Claims Manager, RT Specialty, to dive deep into the reasons why the D&O market has hardened and identify the main drivers of claims activity for 2022 and beyond.

Here are the key takeaways:

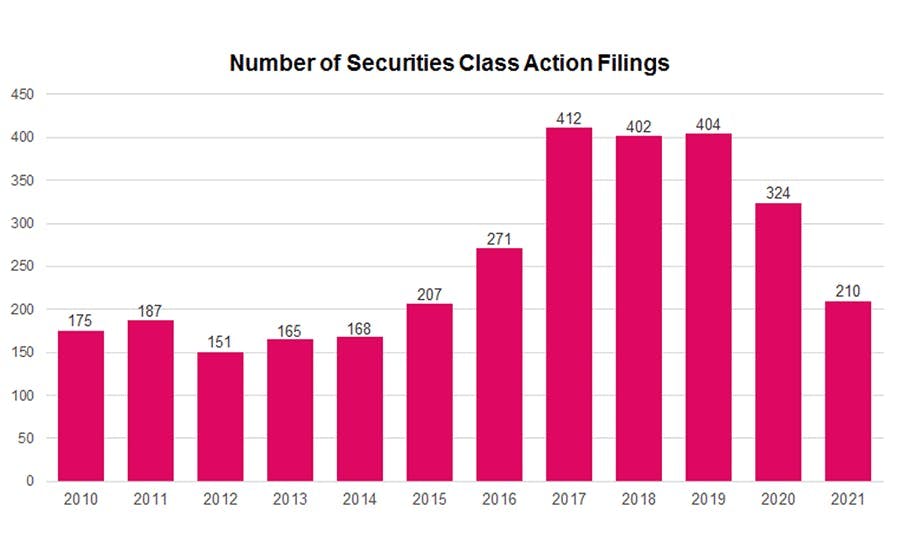

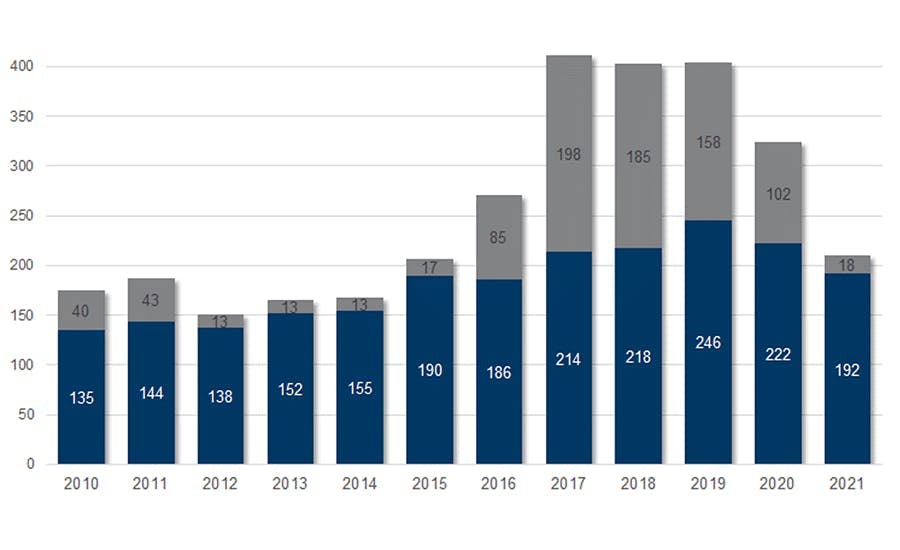

The number of federal securities court class action filings dropped compared to prior years due to a decline in federal court merger objection class action litigation filings, which is a lawsuit where a shareholder plaintiff alleges that either the disclosures or the consideration in connection with the merger were inadequate. SPAC and Coronavirus - related securities class action litigation saw a rise in 2021 and 2022 is trending the same. Core securities class action filings remain elevated relative to historical norms.

Federal court Merger Objection suits saw an increase in prior years due to case law development in Delaware causing plaintiffs' lawyers to start filing their suits in federal rather than state court. In 2021, plaintiffs’ lawyer shifted strategy again, and filed the merger objection suits as individual actions rather than class actions.

One important contribution to the number of securities class action lawsuits filed against Special Purpose Acquisition Companies (SPACs), there were 31 SPAC-related securities class action lawsuits filed against SPACs in 2021, more than half were brought against former SPAC D&O Defendants. With 575 SPACs seeking merger targets as of 2021 and so few of those liquidating, it’s safe to predict there will be quite a bit of SPAC litigation in the coming year.

There were a significant number of Coronavirus-related D&O lawsuits filed in 2020 and in 2021, totaling 42 securities suits. These suits fell into four categories; businesses experiencing outbreaks in their facilities, companies that claimed to be positioned to profit from the coronavirus (e.g., vaccine developers), and corporations whose finances or operations were disrupted by the outbreak. Another category was companies that prospered at the outset of the pandemic but later slumped, such as Peloton.

Regulatory enforcement action can lead to cybersecurity-related D&O litigation as can be seen from the four cases filed against US-listed Chinese Companies that were hit with a crackdown, by Cybersecurity regulators, causing their share price to drop which led to the securities suits.

Lack of diversity in board rooms in corporate America saw a lot of attention in 2021. Among other things, the SEC approved new listing guidelines requiring Nasdaq companies to meet board diversity requirements. In addition, California has enacted legislation required gender diversity and representation from underrepresented communities in the board room. Due to the increased spotlight on board diversity, there were a series of shareholder derivative lawsuits filed against public companies, alleging breach of fiduciary duty because of the board’s lack of diversity. Many of these actions have been unsuccessful and have been dismissed. It should be noted those suits were filed before the aforementioned regulations being put in place. It is doubtful we will see more board diversity lawsuits going into 2022 – rather we may see an increase in DE&I / Employment lawsuits which can further develop into D&O lawsuits.

For more in-depth information, you can view our webinar.

Or reach out to: Deirdre Finn: deirdre.finn@newfront.comDereick Wood: dereick.wood@newfront.comEric Tausend: eric.tausend@newfront.com

Newfront

Newfront is a modern brokerage transforming the risk management, business insurance, total rewards, and retirement services space through the combination of elite expertise and cutting-edge technology. Specializing in more than 20 industries and headquartered in San Francisco, Newfront has offices nationwide and is home to more than 800 employees serving organizations across the United States and globally.