Tax Consequences of Domestic Partner Health Coverage

By Brian Gilmore | Published July 13, 2018

Question: Could you provide a short employee-facing summary of the tax consequences for domestic partner health coverage?

Compliance Team Response:

For employers, we have much more detail available in our Newfront Office Hours webinar Health Benefits for Domestic Partners: Review of the Tax and Coverage Rules for Employers.

Below is a short summary for employees.

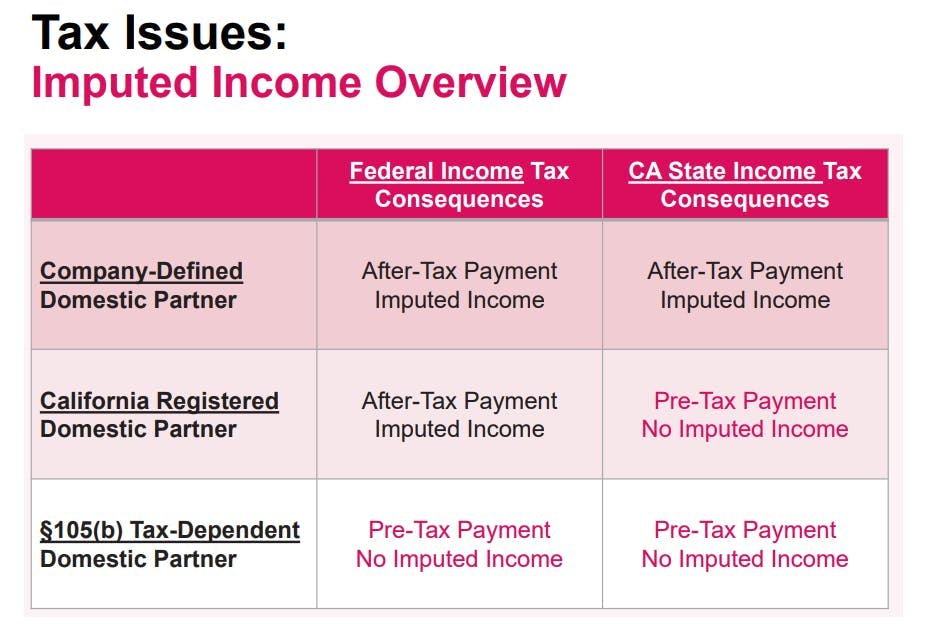

Please be aware that the Company is required by applicable tax law to treat domestic partner coverage as taxable in the following manner:

Post-Tax Payment: Your employee-share of the premium for your domestic partner’s coverage will be paid on a post-tax basis; and

Imputed Income: You will receive imputed income for the fair market value of the employer-share of the premium for domestic partner’s coverage.

There are two ways that your domestic partner’s coverage could avoid all or some of the adverse tax consequences described above:

Tax Dependent—Avoids Federal and State Income Taxes: If your domestic partner qualifies as your tax dependent under Internal Revenue Code §152 (as modified by §105(b)), your domestic partner’s coverage will be treated in the same manner as a spouse for both federal and state income tax purposes. You will avoid both adverse tax consequences listed above at the federal and state income tax level.

Registered Domestic Partnership—Avoids State Income Taxes Only: If your non-tax dependent domestic partner is a Registered Domestic Partner under state law in the state in which you reside (note that not all states offer a Registered Domestic Partnership), your Registered Domestic Partner’s coverage will be treated in the same manner as a spouse to avoid both adverse tax consequences above for state income tax purposes only. Post-tax payment and imputed income will still apply for federal income tax purposes.

If you have any questions about these tax rules that the Company must follow pursuant to applicable tax law, we recommend that you consult with your personal tax advisor.

Newfront Office Hours webinar Health Benefits for Domestic Partners: Review of the Tax and Coverage Rules for Employers

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn