SF HCSO and Employees Who Waive the Health Plan

By Brian Gilmore | Published August 16, 2019

**Question: **Does the SF HCSO require employers to make City Option contributions for employees who waive a very generous offer of employer-sponsored group health plan coverage?

**Short Answer: **Yes, employers will still need to contribute quarterly to the City Option on the waived SF employees’ behalf unless an exception applies.

City Option Contributions Required: The HCSO is a Spending Requirement

The HCSO is a health care spending requirement. It requires covered employers to spend (not merely offer to spend) at least the HCSO required hourly amount for each covered employee unless an exception applies.

Offering a very generous (even free) health plan option to employees is not one of the permitted exceptions. Where an employee waives the employer’s generous offer of group health plan coverage, the employer is not spending any amount on health care for that employee. In other words, the amount that the employer would have spent on the employer-share of the premium for that employee upon enrollment is not actually spent when the employee waives the plan.

Note that an opt-out credit is not considered a health care expenditure and therefore does not apply toward the required HCSO required expenditure. Employees who waive the plan generally must receive both the opt-out credit and the employer HCSO contribution to the City Option.

The result is that unless an exception applies, the employer must still make the required health care expenditure to the City Option (which will typically establish a SF MRA on behalf of the employees) for employees who waive the plan.

Two Main Exceptions that May Apply

HCSO Employee Voluntary Waiver Form

The HCSO Employee Voluntary Waiver Form permits employees to waive their right to City Option contributions. It is valid for a period of one year and may be revoked at any time.

It is generally irrational for employees to waive their right to employer City Option contributions made on their behalf, but nonetheless many do.

Managers/Supervisors Earning over Exemption Threshold

Employees who meet both of the following conditions are exempt from the HCSO health care expenditure requirement regardless of whether they sign a HCSO waiver:

Qualify as a manager or supervisor under the HCSO definition (copied below); AND

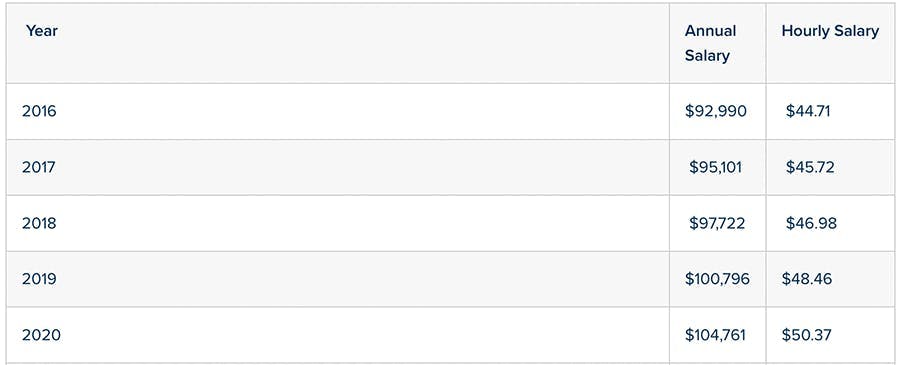

Earn more than the applicable exemption threshold (2019: $100,796 salary, $48.46 hourly rate)

Note that the earnings threshold generally includes commissions but not overtime wages or bonuses.

More Details

Summary

In the vast majority of situations, employees who enroll in the health plan will receive sufficient employer contributions to satisfy the SF HCSO hourly healthcare expenditure requirements.

However, where the employee declines to enroll in the plan for any reason, the employer will generally need to satisfy the SF HCSO hourly healthcare expenditure requirement through contributions to the City Option. This is true even if the health plan offer is free to the employee (or otherwise very generous).

The HCSO is a healthcare spending requirement that cannot be satisfied through the employer-sponsored group health plan if the employee is not enrolled.

Regulations

SF OLSE HCSO FAQ: Covered Employees

https://sfgov.org/olse/c-covered-employees

Q: How does an employee voluntarily waive the right to Health Care Expenditures?

A: If an employee is receiving health care benefits through another employer, s/he is permitted to sign the OLSE Employee Voluntary Waiver Form (PDFs available in English, Chinese, Spanish, Tagalog). The Waiver verifies that the employee is receiving health care benefits through another employer (such as a spouse’s, domestic partner’s or parent’s employer, or this employee’s second job) and that s/he knowingly and voluntarily waives the right to have his/her current employer make Health Care Expenditures on his/her behalf.

Coverage purchased by the employee for him or herself or that the employee is receiving through Medi-Cal or a county health program, is not “benefits received through another employer.” A waiver form that states the employee only has such coverage is not a valid waiver.

Employers must use the OLSE Employee Voluntary Waiver Form, which OLSE developed to ensure that the employee understands his/her rights under the HCSO, so that the waiver is a knowing and voluntary one. Employers may not alter the form in any manner. Other forms provided by third-party vendors or health insurance carriers cannot be used in lieu of the City’s Employee Voluntary Waiver form

Updated January 6, 2016

Q: What makes an Employee Voluntary Waiver Form valid?

A: For an Employee Voluntary Waiver Form to be valid, the employee must fully understand his/her rights under the HCSO, and the Voluntary Waiver must be voluntarily completed by the employee without pressure or coercion from coworkers, the employer, or anyone connected to the employer.

If the employee fails to state on the form that he/she is receiving benefits through another employer, or leaves that section of the waiver form blank, the waiver for is not valid.

An employee voluntary waiver is effective on the date it is signed and is valid for one year or until revoked by the employee. Employees who wish to waive their rights for more than one year must sign a new waiver each year when the prior form expires. Employees cannot waive their rights retroactively.

Employees have the right to revoke their voluntary waiver at any time; the revocation must be submitted in writing. Employers must maintain documentation of waivers and revocations and provide employees with complete copies of such documentation.

An electronic signature is acceptable on the HCSO Employee Voluntary Waiver Form if all of the following conditions are met:

The form is an exact replica of the OLSE’s official Employee Voluntary Waiver Form;

The employee can view the entirety of the form at the same time as they sign it (i.e., the signature is not on a separate page from the form itself);

No language on the website suggests the employee is required to sign the form.

The employer retains a copy of the signed form for its records and also gives the employee a printed copy of the entire signed form.

Updated January 6, 2016

Q: Who qualifies as a Manager, Supervisor, or Confidential Employee?

A: These terms are defined as follows:

Managerial employee: an employee who has authority to formulate, determine, or effectuate employer policies by expressing and making operative the decisions of the employer and who has discretion in the performance of his/her job independent of the employer’s established policies.

Supervisory employee: an employee who has authority, in the interest of the employer, to hire, transfer, suspend, lay off, recall, promote, discharge, assign, reward, or discipline other employees, or the responsibility to direct them, or to adjust their grievances, or effectively to recommend any such action, if the exercise of this authority or responsibility is not of a merely routine or clerical nature, but requires the use of independent judgment.

Confidential employee: an employee who acts in a confidential capacity to formulate, determine, and effectuate management policies with regard to labor relations, or regularly substitutes for employees having such duties.

Q: What is the earnings requirement that goes along with the Managerial, Supervisorial, Confidential Employee exemption?

A: If an employee is a Managerial, Supervisorial, or Confidential Employee and also earns the following annual or hourly rate or a higher rate for the applicable year, that employee is exempt from the HCSO:

The earnings figure represents “the regular rate of pay” as the term is defined and used by the California Labor Commissioner. In that context, the regular rate of pay includes commissions and piece rate wages, but does not include overtime wages, gifts, or most bonuses. Thus, an employee who is a manager and earns an annual base salary that is at or above this figure will be considered exempt from the HCSO even if she is not employed for the full year. Employees who are compensated on an hourly basis and fall into the managerial, supervisory, or confidential employee categories are also exempt from the HCSO if they earn more than the applicable hourly wage listed above.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn