Open Enrollment Rights for FMLA Leaves and COBRA Participants

By Brian Gilmore | Published November 9, 2018

**Question: **Do employees on FMLA leave and COBRA participants have the same open enrollment rights for the health plan as active employees?

Compliance Team Response:

As described in more detail below, both employees on FMLA leave and COBRA participants have the same open enrollment rights for the health plan as active employees.

Employees on FMLA Leave

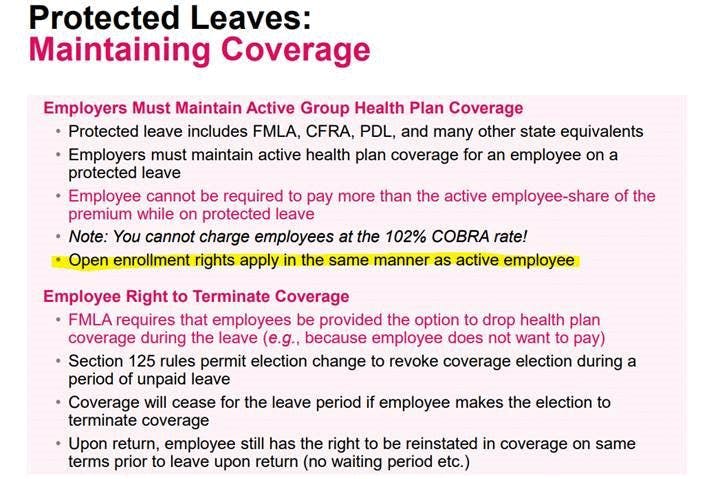

During an FMLA leave, the employer must maintain the employee’s coverage under any group health plan on the same conditions as coverage would have been provided if the employee had been actively at work.

One aspect of this employer requirement to maintain group health coverage is that the employer must also provide employees on FMLA leave with the right to revoke or change elections under the same terms and conditions that apply to employees who are not on FMLA leave.

This means that employers must offer employees on FMLA leave the right to make election changes on the same basis as active employees during the annual open enrollment period. Employees on FMLA leave should have access to the same open enrollment materials as active employees for these purposes.

COBRA Participants (Qualified Beneficiaries)

The COBRA rules require that employers provide qualified beneficiaries with the same open enrollment rights as similarly situated active employees.

There are a few associated issues to be aware of:

COBRA participants have the same right to receive open enrollment materials as active employees.

The IRS has informally stated that COBRA participants may enroll in other health plan types at open enrollment, even if they were not covered by the plan type at the time of the qualifying event (e.g., enroll in dental and vision coverage at OE even if previously covered only by medical).

COBRA participants can change their plan option within health plan types at open enrollment (e.g., change medical plan option from PPO to HMO).

COBRA participants can add dependents at open enrollment (as non-qualified beneficiaries with no independent COBRA rights), even if they were not covered at the time of the qualifying event.

Ideally the employer would provide the same duration of open enrollment to COBRA participants as offered to active employees (the rules suggest that, but are not explicit on the point).

Employees who are still in the COBRA election period are technically considered qualified beneficiaries, and therefore they should have the same open enrollment rights as those who have already elected COBRA.

The DOL has informally stated that qualified beneficiaries must receive reasonable advance notice of increased premiums prior to the annual increase.

Cal-COBRA participants generally have the same open enrollment rights as federal COBRA participants with respect to the employer’s fully insured major medical plan options in California.

Regulations

FMLA

Treas. Reg. §1.125-3, Q/A-6(b)(2)(ii):

(ii) FMLA requires that an employee on FMLA leave have the right to revoke or change elections (because of events described in §1.125-4) under the same terms and conditions that apply to employees participating in the cafeteria plan who are not on FMLA leave. Thus, for example, if a group health plan offers an annual open enrollment period to active employees, then, under FMLA, an employee on FMLA leave when the open enrollment is offered must be offered the right to make election changes on the same basis as other employees. Similarly, if a group health plan decides to offer a new benefit package option and allows active employees to elect the new option, then, under FMLA, an employee on FMLA leave must be allowed to elect the new option on the same basis as other employees.

29 CFR §825.209:

(a) _ During any FMLA leave, an employer must maintain the employee’s coverage under any group health plan (as defined in the Internal Revenue Code of 1986 at 26 U.S.C. 5000(b)(1) on the same conditions as coverage would have been provided if the employee had been continuously employed during the entire leave period._ All employers covered by FMLA, including public agencies, are subject to the Act’s requirements to maintain health coverage. The definition of group health plan is set forth in §825.102…

…

**(e) ** An employee may choose not to retain group health plan coverage during FMLA leave. However, when an employee returns from leave, the employee is entitled to be reinstated on the same terms as prior to taking the leave, including family or dependent coverages, without any qualifying period, physical examination, exclusion of pre-existing conditions, etc. See §825.212(c).

COBRA

Treas. Reg. 54.4980B-5, Q/A-4:

**Q-. 4. . ** Can a qualified beneficiary who elects COBRA continuation coverage ever change from the coverage received by that individual immediately before the qualifying event?

**A-4. **

…

(c) If an employer or employee organization makes an open enrollment period available to similarly situated active employees with respect to whom a qualifying event has not occurred, the same open enrollment period rights must be made available to each qualified beneficiary receiving COBRA continuation coverage. An open enrollment period means a period during which an employee covered under a plan can choose to be covered under another group health plan or under another benefit package within the same plan, or to add or eliminate coverage of family members.

…

Example (1).

(i) E is an employee who works for an employer that maintains several group health plans. Under the terms of the plans, if an employee chooses to cover any family members under a plan, all family members must be covered by the same plan and that plan must be the same as the plan covering the employee. Immediately before E’s termination of employment (for reasons other than gross misconduct), E is covered along with E’s spouse and children by a plan. The coverage under that plan will end as a result of the termination of employment.

(ii) Upon E’s termination of employment, each of the four family members is a qualified beneficiary. Even though the employer maintains various other plans and options, it is not necessary for the qualified beneficiaries to be allowed to switch to a new plan when E terminates employment.

(iii) COBRA continuation coverage is elected for each of the four family members. Three months after E’s termination of employment there is an open enrollment period during which similarly situated active employees are offered an opportunity to choose to be covered under a new plan or to add or eliminate family coverage.

(iv) During the open enrollment period, each of the four qualified beneficiaries must be offered the opportunity to switch to another plan (as though each qualified beneficiary were an individual employee). For example, each member of E’s family could choose coverage under a separate plan, even though the family members of employed individuals could not choose coverage under separate plans. Of course, if each family member chooses COBRA continuation coverage under a separate plan, the plan can require payment for each family member that is based on the applicable premium for individual coverage under that separate plan. See Q&A-1 of §54.4980B-8.

Example (2).

(i) The facts are the same as in Example 1, except that E’s family members are not covered under E’s group health plan when E terminates employment.

(ii) Although the family members do not have to be given an opportunity to elect COBRA continuation coverage, E must be allowed to add them to E’s COBRA continuation coverage during the open enrollment period. This is true even though the family members are not, and cannot become, qualified beneficiaries (see Q&A-1 of §54.4980B-3).

ERISA §607(3)(A):

_(3) _Qualified beneficiary.

(A) In general. The term “qualified beneficiary” means, with respect to a covered employee under a group health plan, any other individual who, on the day before the qualifying event for that employee, is a beneficiary under the plan—

(i) as the spouse of the covered employee, or

(ii) as the dependent child of the employee.

Such term shall also include a child who is born to or placed for adoption with the covered employee during the period of continuation coverage under this part [29 USC §§1161 et seq.].

ABA JCEB DOL Q/A (May 7, 2008):

https://www.americanbar.org/content/dam/aba/migrated/jceb/2008/DOL2008.authcheckdam.pdf

Question 5: How much advance notice must the employer provide of the annual increase in the COBRA premium?

…

**DoL Answer 5: **The Staff acknowledges that neither the COBRA notice provisions in Part 6 of Title I of the Employee Retirement Income Security Act of 1974, as amended (ERISA) nor the DoL’s COBRA notice regulations (29 C.F.R. §§ 2590.606-1 through 2590.606-4) explicitly provide for advance notice of a COBRA premium increase. Nonetheless, Treasury regulations provide that if a COBRA premium payment is short by an amount that is insignificant, the qualified beneficiary must be provided notice of such underpayment and a reasonable amount of time to make the payment difference. See Treasury Regulation § 54.4980B-8, Question and Answer 5. Likewise, both the statute and Treasury regulations include provisions requiring equal coverage and, to some extent, equal treatment between COBRA qualified beneficiaries and same similarly situated non-COBRA beneficiaries. See ERISA § 602(1) and Treasury Regulation § 54.4980B- 5, Question and Answer 1. Accordingly, in the Staff’s view, COBRA continuation coverage should not be terminated for insufficient payment if COBRA qualified beneficiaries are not provided a reasonable advance notice of increased premiums and a reasonable opportunity to pay the increased premium.

ABA JCEB IRS Q/A (May 9, 2003):

https://www.americanbar.org/content/dam/aba/migrated/jceb/2003/qa03irs.pdf

§4980B – Continuation Coverage

An employee was a participant in the company’s group dental plan at termination of employment, but was not a participant in the company’s group medical plan. The employee elected to continue his dental coverage under COBRA. During the period of the employee’s dental COBRA continuation coverage, the company had open enrollment for employees. Can the former employee who is receiving dental continuation coverage under COBRA (and is a COBRA qualified beneficiary) elect coverage under the group medical plan during the open annual enrollment period?

**Proposed response: **The COBRA regulations provide in Treas. Reg. 54.4980B-5(iv) Q&A 4(c) that the same open enrollment period rights available to similarly situated active employees must be available to each qualified beneficiary receiving COBRA continuation coverage. Open enrollment period is defined as a period during which an employee covered under a plan can choose to be covered under another group health plan or under another benefit package within the same plan, or to add or eliminate coverage of family members. Therefore, the individual in the question could elect to participate in the group medical plan during the open annual enrollment period.

IRS response: The IRS agrees with the proposed answer. If the plan did not allow active employees who had previously elected only dental coverage to add group medical coverage during the open enrollment period, the plan would not be required to allow COBRA qualified beneficiaries who had elected only dental to add group medical coverage either.

California Insurance Code §10128.53(b) [Cal-COBRA]:

**(b) ** Every disability insurer shall also offer the continuation coverage to a qualified beneficiary who (1) elects continuation coverage under a group benefit plan as defined in this article or in Section 1366.21 of the Health and Safety Code, but whose continuation coverage is terminated under the group benefit plan pursuant to subdivision (b) of Section 10128.57, prior to any other termination date specified in Section 10128.57, or (2) who elects coverage through the disability insurer during any employer open enrollment, and the employer has contracted with the disability insurer to provide coverage to the employer’s active employees. This continuation coverage shall be provided only for the balance of the period that the qualified beneficiary would have remained covered under the prior group benefit plan had the employer not terminated the contract with the previous insurer or health care service plan.

California DMHC Cal-COBRA Summary:

What are my benefits under Federal COBRA and Cal-COBRA?

You have the same benefits as other employees in the same plan.

If other employees have open enrollment periods when they can change from one plan to another, you can too.

If the employer changes the employees from one plan to another, you change too.

You have no restrictions because of pre-existing conditions.

If the group plan offers specialized plans, such as dental or vision plans, they must be offered to you too. However, if you change from Federal COBRA to Cal-COBRA, these specialized plans do not have to be offered to you.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn