NY Paid Family Leave Benefits Increase for 2022

By Karen Hooper | Published September 16, 2021

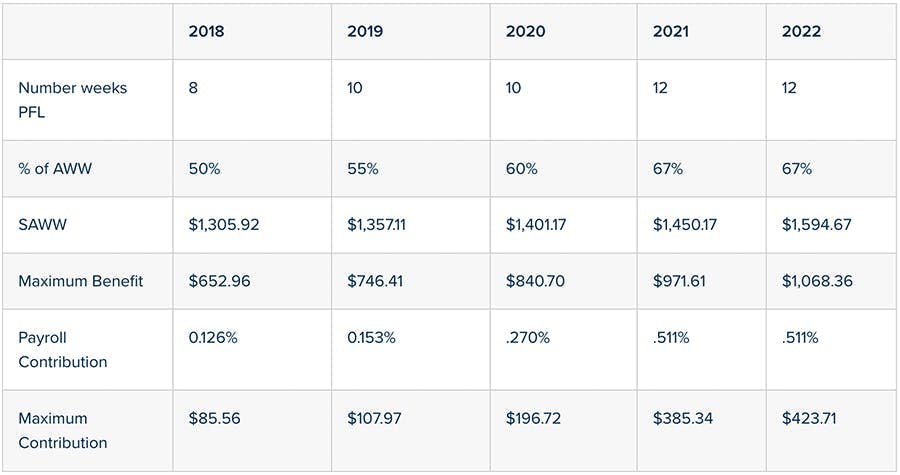

New York State’s Paid Family Leave Law four-year phase-in is complete with the premium rate and maximum contribution amount set for 2022.

In 2018, New York joined the emerging and expanding group of states to offer paid family and medical leave. The program has been phased in over the first four-year period from 2018-2021, with increased benefits and premiums over the course of the transitional period.

For full details, see our prior posts:

The New York Department of Financial Services recently completed its evaluation of the financial health of the paid family leave program over that phase-in period and determined it will retain the employee contribution rate at .511% for 2022 (.506% plus a .005% risk adjustment for COVID-19 claims paid). The 2022 premium amount will be capped at an annual maximum employee contribution of $423.71 (up from $385.34 in 2021).

Under the New York paid family leave law, employees are able to take up to 12 weeks of job protected and benefit protected paid family leave to bond with a new child, care for a family member with a serious health condition, or assist loved ones when a family member is deployed on active military service. Employees who need to quarantine or care for a family member during quarantine may also qualify for leave.

The paid leave benefit an employee can receive remains at 67% of the employee’s average weekly wage (AWW), capped at a maximum weekly benefit of $1,068.36 for 2022 (an increase of $96.75 from 2021). The maximum benefit is calculated based on 67% of the $1,594.57 State Average Weekly Wage (SAWW).

2022 New York Paid Family Leave Amounts After Completion of Four-Year Phase-In

For more information on New York State Paid Family Leave, visit the New York State Paid Family Leave website. For more information on the updates visit the New York Paid Family Leave Updates for 2022 website.

Karen Hooper

VP, Senior Compliance Manager

Karen Hooper, CEBS, CMS, Fellow, is a Vice President and Senior Compliance Manager working closely with the Lead Benefit Counsel in Newfront's Employee Benefits division. She works closely with internal staff and clients regarding compliance issues, providing information, education and training.