New York to Offer Paid Family Leave in 2018; DC Law to Take Effect in 2019

By Karen Hooper | Published June 1, 2017

Of the 12 states and District of Columbia with family and medical leave laws, only three states – California, New Jersey and Rhode Island currently offer paid family and medical leave.

New York is set to become the fourth state effective January 1, 2018. The program will be phased in over a four-year period and will be funded by an employee payroll deduction estimated to be between $.45 to $1.00 per week. While the payroll deduction is scheduled to begin July 1, 2017 in advance of the law taking effect, the State Superintendent of Financial Services has not yet released the maximum employee contribution.

New York State Paid Family Leave Overview

The State’s Paid Family Leave program (PFL) will provide employees with wage replacement to:

bond with a child (including adopted children and foster children),

care for a close relative with a serious health condition, or

to help relieve family pressures when someone is called to active military service.

A “close relative” is defined as a: spouse, domestic partner, child, parent, parent-in-law, grandparent or grandchild.

“Serious health condition” is an illness, injury, impairment or physical or mental condition that involves inpatient care in a hospital, hospice, or residential health care facility; or continuing treatment or continuing supervision by a health care provider.

Employees who have been employed full time for 26 weeks or part-time for 175 days are eligible to apply for leave effective January 1, 2018.

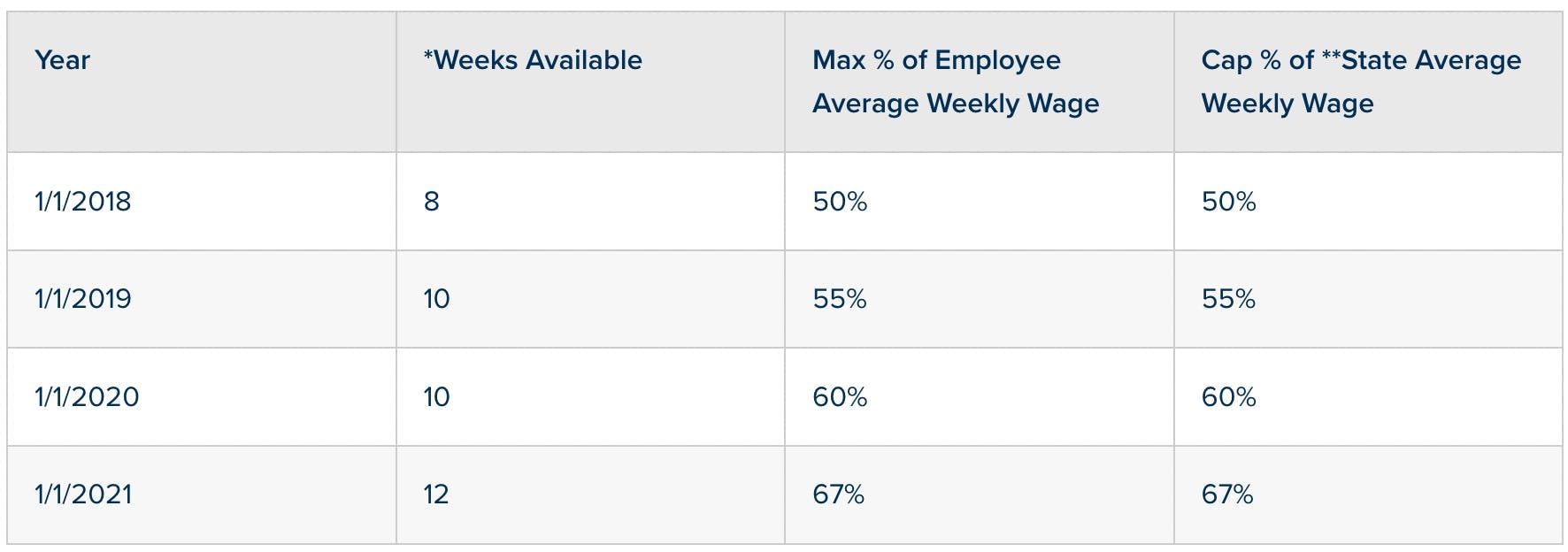

Paid Family Leave will be phased in over a four-year period. Employees will receive a percentage of their weekly wage, capped at the New York State Average Weekly Wage. Paid family leave can be taken intermittently, but is only available in full day increments.

*Weeks are available within a consecutive 52-week period starting from the first day for which benefits are claimed.

**Current New York State Average weekly wage is $1,296

PFL is a job protected leave, and employees are entitled to be reinstated to the same or a comparable job on return from leave. Employers must also continue the employee’s group health coverage on the same terms as if the employee had continued to work. PFL can’t be used for the employee’s own disability or qualifying military event.

Who Must Provide PFL?

The law applies to all private employers. The State definition of an eligible employer is “an employer with one or more employees on each of at least 30 days in any calendar year is required to provide paid family leave upon the expiration of four weeks after the 30th day of employment”.

Public employers may opt into the program and public employees represented by a union may be covered if Paid Family Leave is collectively bargained.

How does an Employer obtain a PFL Policy?

Employers will be required to purchase a paid family leave policy, or self-insure. Every carrier who provides statutory disability benefit policies in New York must also provide paid family leave policies. The premium for the policy will be paid by the employees through payroll deduction.

What are the Employer Responsibilities?

Employers have certain notice and display requirements:

Update handbooks with information concerning PFL and the employee obligations.

If no written policies or handbooks, provide written guidance to each employee concerning the employee’s rights and obligations under PFL, including information on how to file a claim for PFL.

Display or post a printed notice concerning PFL.

Employers may deduct up to the maximum weekly employee contribution prior to the effective date of the policy. If an employer fails to withhold PFL contributions, the law does not permit the employer to deduct catch up contributions that are greater than the maximum weekly amount.

What are the Employee Responsibilities?

Employees must provide 30-day advance notice if at all possible, complete the claim form and provide the required supporting documentation depending on the type of leave.

Employees who work part-time and have multiple jobs may not take Paid Family Leave for a single qualifying event from different covered employers at separate intervals. Leave for the same qualifying event must be taken from all employers at the same time.

Coordination with Other Leaves

Employers may permit employees to use sick leave and or vacation before using paid family leave, but can’t require employees to use this leave. Employees may use sick or vacation time to supplement PFL up to their full salary.

If an employee is eligible for a disability benefit and family leave during the same 52 consecutive calendar weeks, the employee can only receive a total of 26 weeks combined disability and PFL.

Employees must use FMLA and Paid Family Leave concurrently.

Employers whose policy is to continue paying employees full salary while out on family leave will be entitled to reimbursement from the carrier providing PFL benefits.

What are the Penalties for Non-Compliance

The penalty for non-compliance is 0.5% of the employer’s weekly payroll for the period of non-compliance plus an additional sum not to exceed $500.

The New York PFL website has additional information and FAQ’s for employers as well as information and FAQ’s for employees.

Other Paid Family Leave Laws in the Works

The District of Columbia Council just approved the Universal Paid Leave Act of 2016 (UPLA). This law becomes effective in 2019 and applies to all employers with employees in DC, regardless of size. The program will be funded by a .62% payroll tax on covered employers.

Employees who spend more than 50% of their time working for an employer within the District of Columbia will receive during any 52 week period:

8 weeks of parental leave

6 weeks of family care leave

2 weeks of personal medical leave

There is a one week waiting period for the leave, and the amount of payment to the employee will be based on a sliding wage scale. More information to come on this one.

Karen Hooper

VP, Senior Compliance Manager

Karen Hooper, CEBS, CMS, Fellow, is a Vice President and Senior Compliance Manager working closely with the Lead Benefit Counsel in Newfront's Employee Benefits division. She works closely with internal staff and clients regarding compliance issues, providing information, education and training.