Late Health Plan Payments on FMLA Leave

By Brian Gilmore | Published October 19, 2018

Question: When can an employer terminate health benefits for an employee on FMLA leave for failure to timely pay the employee-share of the premium? What are the employee’s COBRA rights?

Compliance Team Response:

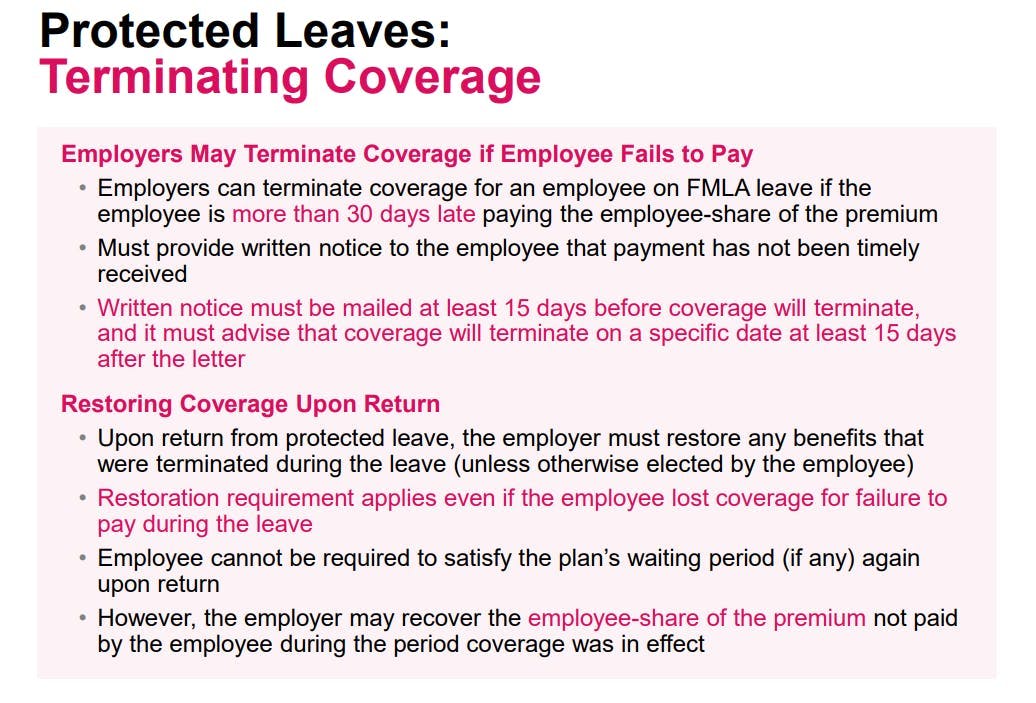

Payment Must Be More Than 30 Days Late

Employers can terminate coverage for an employee on FMLA leave if the employee is more than 30 days late paying the employee-share of the premium.

15-Day Notice Letter Required

FMLA requires that the employer provide written notice to inform the employee that it has not timely receive the required payment. That written notice must be mailed at least 15 days before coverage will terminate. The letter must advise that coverage will terminate on a specific date at least 15 days after the letter.

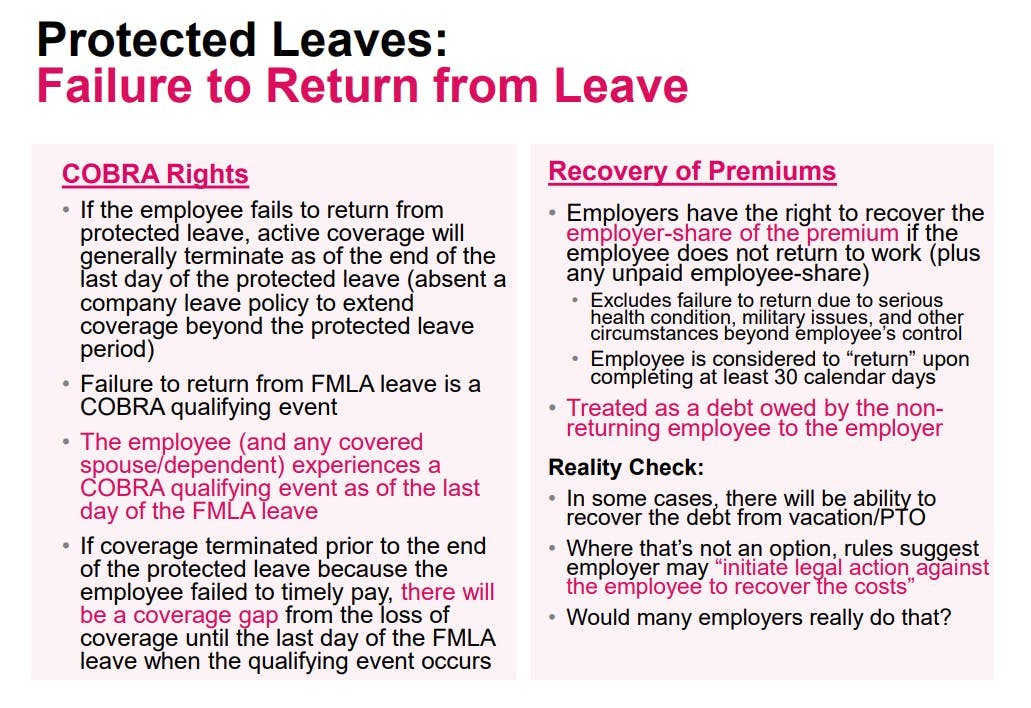

No COBRA Rights Upon Failure to Timely Pay

Upon coverage terminating, the employee does not experience a COBRA qualifying event. Failure to timely pay the required premium is not one of the triggering events that can create COBRA rights.

COBRA Qualifying Event if Employee Fails to Return to Work (Coverage Gap)

If the employee fails to return from the FMLA leave, the employee will experience a COBRA qualifying event as of the last day of the protected leave. That means there will be a gap between the loss of coverage date (for failure to timely pay the employee-share of the premium) and the date of the COBRA qualifying event (end of the protected leave period).

For example, if the employee’s coverage terminated as of the end of September 30 for failure to timely pay while on leave, and the employee exhausted FMLA and failed to return as of November 1, the month of October would be a coverage gap under the employer-sponsored group health plan. The employee’s active coverage would have run through September, but COBRA rights would not be available until November 1 (the date of the qualifying event).

This is one of only two scenarios where COBRA would not provide continuous, seamless continuation coverage (the other being removal of a spouse in anticipation of divorce).

Restoring Coverage Upon Return

Upon return from leave, the employer must restore any benefits that were terminated during the leave (unless otherwise elected by the employee). This requirement applies even if the employee dropped or lost coverage for failure to timely pay during the leave. Furthermore, the employee cannot be required to satisfy the plan’s waiting period (if any) again upon return.

However, the employer may recover the employee-share of the premium not paid by the employee during the period of FMLA leave that coverage remained in effect.

Where Can I Find More Details?

Newfront Office Hours Webinar: Health Benefits While on Leave: The Rules All Employers Need to Know

Newfront Compliance FAST: Health Benefits During Protected Leave

Newfront Leave Charts: Newfront Federal and California Leave Charts (with Examples)

Regulations

29 CFR §825.212:

(a) (1) In the absence of an established employer policy providing a longer grace period, an employer’s obligations to maintain health insurance coverage cease under FMLA if an employee’s premium payment is more than 30 days late. In order to drop the coverage for an employee whose premium payment is late, the employer must provide written notice to the employee that the payment has not been received. Such notice must be mailed to the employee at least 15 days before coverage is to cease, advising that coverage will be dropped on a specified date at least 15 days after the date of the letter unless the payment has been received by that date. If the employer has established policies regarding other forms of unpaid leave that provide for the employer to cease coverage retroactively to the date the unpaid premium payment was due, the employer may drop the employee from coverage retroactively in accordance with that policy, provided the 15-day notice was given. In the absence of such a policy, coverage for the employee may be terminated at the end of the 30-day grace period, where the required 15-day notice has been provided.

(2) An employer has no obligation regarding the maintenance of a health insurance policy which is not a group health plan. See §825.209(a) .

(3) All other obligations of an employer under FMLA would continue; for example, the employer continues to have an obligation to reinstate an employee upon return from leave.

(b) The employer may recover the employee’s share of any premium payments missed by the employee for any FMLA leave period during which the employer maintains health coverage by paying the employee’s share after the premium payment is missed.

(c) If coverage lapses because an employee has not made required premium payments, upon the employee’s return from FMLA leave the employer must still restore the employee to coverage/benefits equivalent to those the employee would have had if leave had not been taken and the premium payment(s) had not been missed, including family or dependent coverage. See §825.215(d)(1)-(5). In such case, an employee may not be required to meet any qualification requirements imposed by the plan, including any new preexisting condition waiting period, to wait for an open season, or to pass a medical examination to obtain reinstatement of coverage. If an employer terminates an employee’s insurance in accordance with this section and fails to restore the employee’s health insurance as required by this section upon the employee’s return, the employer may be liable for benefits lost by reason of the violation, for other actual monetary losses sustained as a direct result of the violation, and for appropriate equitable relief tailored to the harm suffered.

Treas. Reg. §54.4980B-10, Q/A-2:

Q-2. If a qualifying event described in Q&A-1 of this section occurs, when does it occur, and how is the maximum coverage period measured?

A-2. A qualifying event described in Q&A-1 of this section occurs on the last day of FMLA leave. (The determination of when FMLA leave ends is not made under the rules of this section. See the FMLA regulations, 29 CFR Part 825 (§§825.100-825.800).) The maximum coverage period (see Q&A-4 of §54.4980B-7) is measured from the date of the qualifying event (that is, the last day of FMLA leave).

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn