HSA Interaction with Health FSA

By Brian Gilmore | Published March 24, 2017

Participation in a general purpose FSA can be a disqualifying plan for making contributions into a HSA.

Question: How do the HSA eligibility rules work for an employee or spouse who is covered by a health FSA for part of the year?

Compliance Team Answer:

HSA Eligibility: General Rule

The general rule is that an individual must meet two requirements to be HSA-eligible (i.e., to be eligible to make or receive HSA contributions):

Be covered by an HDHP; and

Have no disqualifying coverage (generally any medical coverage that pays pre-deductible).

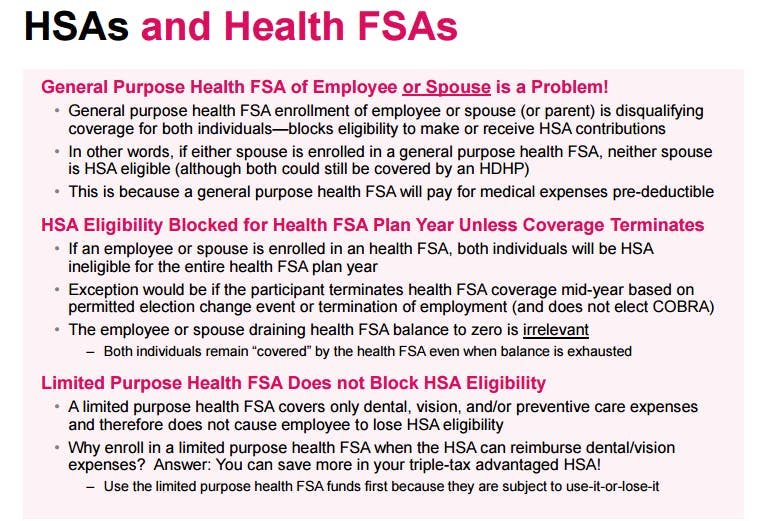

Health FSA: Blocks HSA Eligibility for Employee and Spouse

Coverage under a general purpose health FSA for the employee or spouse is disqualifying coverage for both individuals. This is because an employee can reimburse pre-deductible expenses under the health FSA for both the employee and the spouse.

The result is that if either spouse is enrolled in a general purpose health FSA, neither spouse is HSA eligible. They can still be covered by an HDHP, but they cannot make or receive HSA contributions.

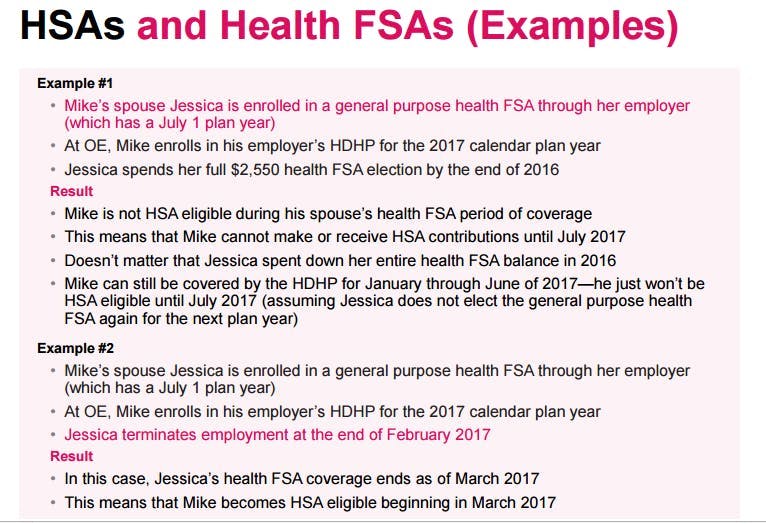

Health FSA Period of Coverage: Generally Entire Year

The employee and spouse are not HSA-eligible for as long as the employee or spouse remains covered under a general purpose health FSA (i.e., expenses are eligible for reimbursement). The employee and spouse are still covered by the health FSA even if they drain the account balance to zero.

Example: Employee’s spouse is enrolled in a calendar year general purpose health FSA for 2017. The employee would not be HSA eligible for all of 2017 even if the spouse drained the FSA account to zero mid-year.

Health FSA Period of Coverage: Mid-Year Termination

If an employee or spouse terminates from employment or experiences a Section 125 permitted election change event to revoke the health FSA election, the period of coverage under the health FSA will end. In other words, as of the effective date of the employee’s loss of eligibility or revocation of election for the health FSA, the employee can no long incur claims that would be reimbursable under the health FSA.

Example: Employee’s spouse terminates from employment today (March 24), and loses coverage under the health FSA as of today. The spouse will typically have a 90-day run-out period to submit claims incurred prior to termination. The run-out period is not coverage under the health FSA (because claims incurred during the run-out are not reimbursable), and therefore it does not affect the employee’s or spouse’s HSA eligibility. HSA eligibility is determined as of the first day of each calendar month, so the employee could become HSA eligible as of April 1 (assuming the employee is covered by an HDHP and has no other disqualifying coverage).

Note that the example above assumes the spouse does not elect COBRA for the health FSA. Coverage under the health FSA will continue through the end of the plan year (and possibility longer if there is a $500 carryover provision) if the spouse elects COBRA.

Employer Not Responsible for Determining HSA Eligibility

Employers are not responsible for determining whether an employee is HSA eligible, other than a) confirming that the employee is enrolled in an HDHP and has no disqualifying coverage from that employer (i.e., no responsibility for tracking coverage through a spouse/parent/DP), and b) confirming the employee’s age for purposes of catch-up contribution eligibility. HSA eligibility is therefore almost entirely an individual income tax issue.

In other words, the employer has no responsibility for tracking whether an employee’s spouse is enrolled in a general purpose health FSA. That is entirely the employee’s responsibility.

Summary

A spouse’s general purpose health FSA enrollment is disqualifying coverage for the both the spouse and the employee. This is because the both the employee’s and the spouse’s pre-deducible medical expenses are reimbursable by the health FSA.

Therefore, if either the employee or spouse are enrolled in a general purpose health FSA, both the employee and the spouse are not HSA-eligible (i.e., they cannot make or receive HSA contributions) for as long as that health FSA coverage remains in effect.

Regulations:

IRS Notice 2005-86:

https://www.irs.gov/pub/irs-drop/n-05-86.pdf

Interaction Between HSAs and Health FSAs

Section 223(a) allows a deduction for contributions to an HSA for an “eligible individual” for any month during the taxable year. An “eligible individual” is defined in § 223(c)(1)(A) and means, in general, with respect to any month, any individual who is covered under an HDHP on the first day of such month and is not, while covered under an HDHP, “covered under any health plan which is not a high-deductible health plan, and which provides coverage for any benefit which is covered under the high-deductible health plan.”

In addition to coverage under an HDHP, § 223(c)(1)(B) provides that an eligible individual may have disregarded coverage, including “permitted insurance” and “permitted coverage.” Section 223(c)(2)(C) also provides a safe harbor for the absence of a preventive care deductible. See Notice 2004-23, 2004-1 C.B. 725. Therefore, under § 223, an individual who is eligible to contribute to an HSA must be covered by a health plan that is an HDHP, and may also have permitted insurance, permitted coverage and preventive care, but no other coverage. A health FSA that reimburses all qualified § 213(d) medical expenses without other restrictions is a health plan that constitutes other coverage. Consequently, an individual who is covered by a health FSA that pays or reimburses all qualified medical expenses is not an eligible individual for purposes of making contributions to an HSA. This result is the same even if the individual is covered by a health FSA sponsored by a spouse’s employer.

However, as described in Rev. Rul. 2004-45, 2004-1 C.B. 971, an individual who is otherwise eligible for an HSA may be covered under specific types of health FSAs and remain eligible to contribute to an HSA. One arrangement is a limited-purpose health FSA, which pays or reimburses expenses only for preventive care and “permitted coverage” (e.g., dental care and vision care). Another HSA-compatible arrangement is a post-deductible health FSA, which pays or reimburses preventive care and for other qualified medical expenses only if incurred after the minimum annual deductible for the HDHP under § 223(c)(2)(A) is satisfied. This means that qualified medical expenses incurred before the HDHP deductible is satisfied may not be reimbursed by a post-deductible HDHP even after the HDHP deductible had been satisfied. To summarize, an otherwise HSA eligible individual will remain eligible if covered under a limited-purpose health FSA or a post-deductible FSA, or a combination of both.

IRS Notice 2004-50, Q/A-81:

https://www.irs.gov/irb/2004-33_IRB/ar08.html

Q-81. Are employers who contribute to an employee’s HSA responsible for determining whether the employee is an eligible individual and the employee’s maximum annual contribution limit?

A-81. Employers are only responsible for determining the following with respect to an employee’s eligibility and maximum annual contribution limit on HSA contributions: (1) whether the employee is covered under an HDHP (and the deductible) or low deductible health plan or plans (including health FSAs and HRAs) sponsored by that employer; and (2) the employee’s age (for catch-up contributions). The employer may rely on the employee’s representation as to his or her date of birth.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn