How Medicare Affects HSA Eligibility

By Brian Gilmore | Published November 15, 2019

**Question: **How does Medicare enrollment affect HSA eligibility?

**Short Answer: **Individuals who enroll in any part of Medicare lose HSA eligibility, which means they cannot make or receive HSA contributions.

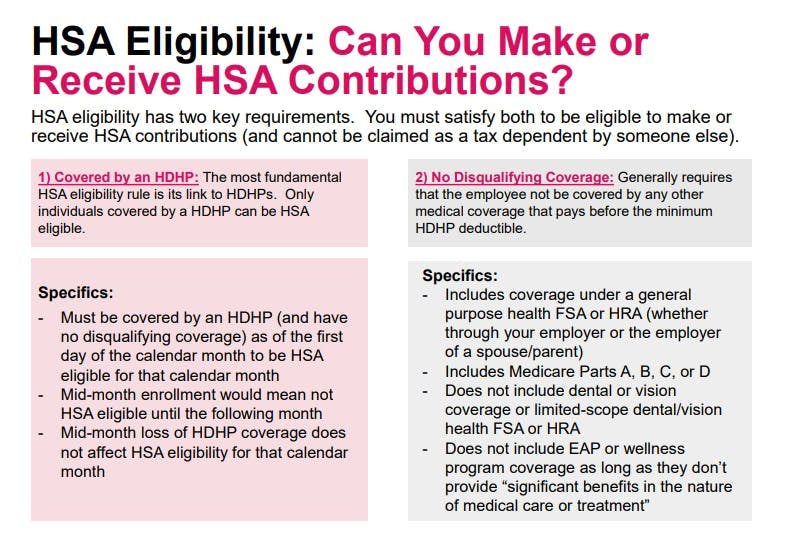

General Rule: HSA Eligibility

The general rule is that an individual must meet two requirements to be HSA-eligible (i.e., to be eligible to make or receive HSA contributions):

Be covered by an HDHP; and

Have no disqualifying coverage (generally any medical coverage that pays pre-deductible, including Medicare).

HSA eligibility also requires that the individual cannot be claimed as a tax dependent by someone else.

Medicare is Disqualifying Coverage

Enrollment in any part of Medicare is disqualifying coverage that causes an individual to lose HSA eligibility.

This means that an individual who is enrolled in Medicare Part A, Part B, Part C, Part D, or any combination thereof is not eligible to make or receive HSA contributions. Even enrollment in only the (generally premium-free) Medicare Part A hospital coverage blocks HSA eligibility.

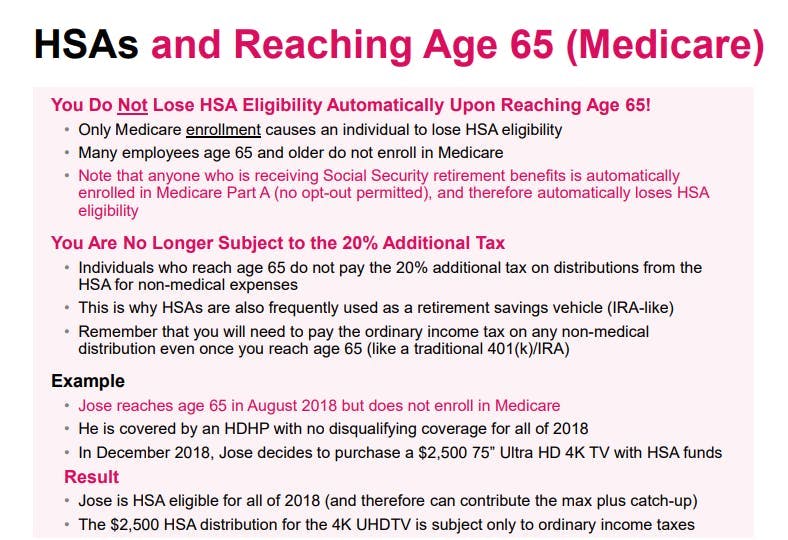

Individuals Who Are Age 65+ May Still Be HSA Eligible

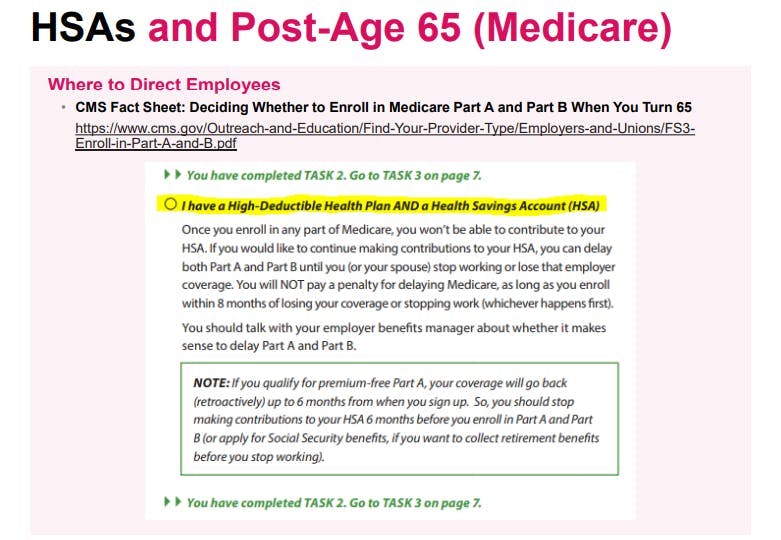

Medicare enrollment causes an individual to lose HSA eligibility. However, many employees age 65 and older delay enrollment in Medicare, and therefore may continue to be HSA-eligible.

In other words, mere eligibility to enroll in Medicare has no effect on the individual’s HSA eligibility if the individual chooses not to enroll in any part of Medicare.

The Medicare Part A Automatic Enrollment Trap: Individuals Receiving Social Security Retirement Benefits

Individuals who are receiving Social Security retirement benefits are automatically enrolled in (premium-free) Medicare Part A hospital coverage with no opt-out permitted.

Accordingly, any individual receiving Social Security retirement benefits is not HSA eligible by virtue of the automatic Medicare Part A enrollment.

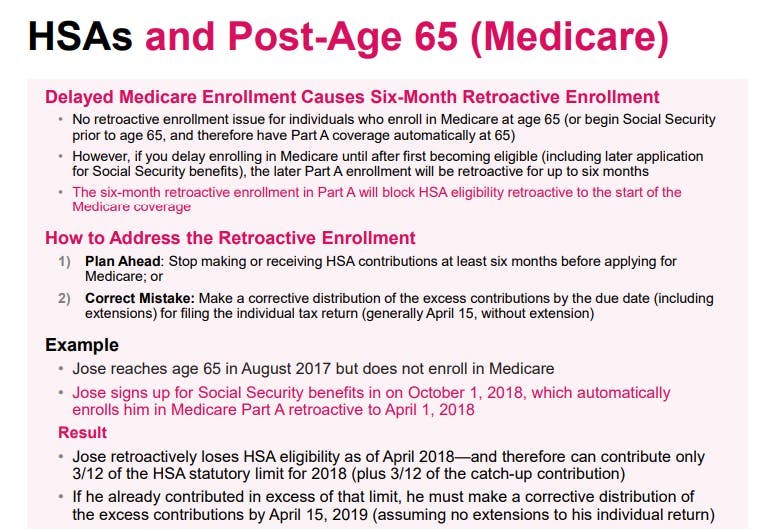

The Medicare Part A Retroactive Enrollment Trap: Six Months of Retroactive Coverage

For individuals who delay enrolling in Medicare until after age 65, the Medicare Part A enrollment will be effective retroactively up to six months. This six-month retroactive enrollment in Medicare Part A will also block HSA eligibility retroactively for six months.

Individuals have two options to address the retroactive Medicare Part A enrollment causing the retroactive loss of HSA eligibility:

Plan Ahead: Stop making HSA contributions at least six months before applying for Medicare, and limit HSA contributions during that period to the prorated amount; or

Correct Mistake: Work with the HSA custodian to take a corrective distribution of the excess contributions by the due date (including extensions) for filing the individual tax return (generally April 15, without extension).

Example:

Jose reaches age 65 in August 2018 but does not enroll in Medicare.

Jose signs up for Social Security benefits on October 1, 2019, which automatically enrolls him in Medicare Part A retroactive to April 1, 2019.

Result:

Jose retroactively loses HSA eligibility as of April 2019—and therefore he can contribute only 3/12 of the HSA statutory limit for 2019 (plus 3/12 of the catch-up contribution).

If he already contributed in excess of that limit, Jose will need to make a corrective distribution of the excess contributions by April 15, 2020 (assuming no extensions) to avoid a 6% excise tax.

Good News Reminder: HSA Can Be Used for Medicare Premiums

Although the general rule is that individuals cannot take tax-free medical distributions for premium expenses, one exception is for Medicare premiums once the individual reaches age 65.

So even though individuals are no longer eligible to contribute to an HSA upon enrollment in Medicare, individuals with a remaining HSA balance can use those funds to pay for their Medicare premium costs tax-free.

Keep in mind that individuals cannot take a tax-free medical distribution for Medicare supplement premiums, such as Medigap.

Good News Reminder: 20% Additional Tax Does Not Apply at Age 65+

The general rule is that a non-medical HSA distribution is subject to ordinary income taxes plus a 20% additional tax.

However, individuals who are age 65+ are not subject to the 20% additional tax for non-medical distributions. Only standard ordinary income taxes apply to non-medical distributions (in the same manner as a traditional 401(k) or IRA distribution) upon reaching age 65.

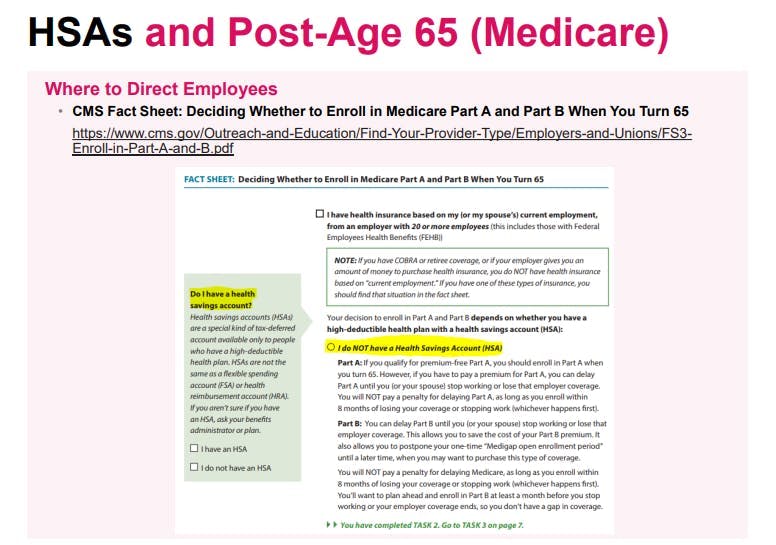

More Details on Medicare for Employers and Employees

Employee-Facing Medicare Summary: Newfront Medicare Resources Guide for Employees

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn