Excess HSA Contributions

By Brian Gilmore | Published August 24, 2018

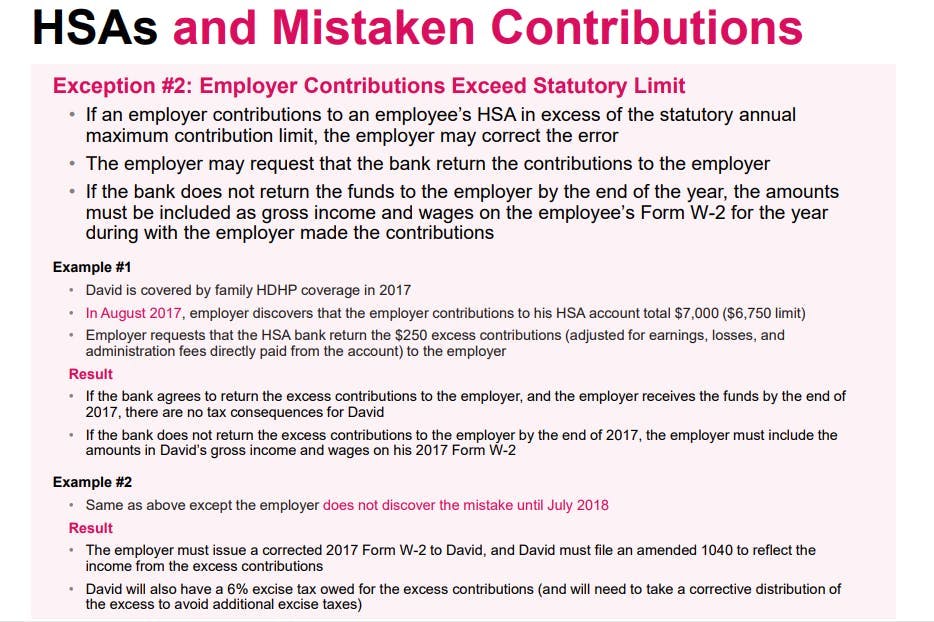

Question: What is the process where an employer accidentally contributes to an employee’s HSA in excess of the statutory limit?

Option 1 (Returned by Bank):

The preferred option is for the employer to request that the custodian return the excess contributions to the company. The custodian is not required to agree to this request. HSA custodians take different positions on this, but most will agree to the refund.

If the custodian agrees, the next issue is whether the excess contributions were employer or employee contributions. If the excess amounts were employee pre-tax contributions, the employer will pay the returned amount to the employee as standard taxable wages subject to withholding and payroll taxes.

If the excess contributions were employer contributions, the employer will simply accept the refunded amounts from the custodian. As long as the funds are removed from the HSA and returned to the employer by the end of the year in which the excess contributions occurred, there are no tax consequences to the employee.

Option 2 (Employee Corrects):

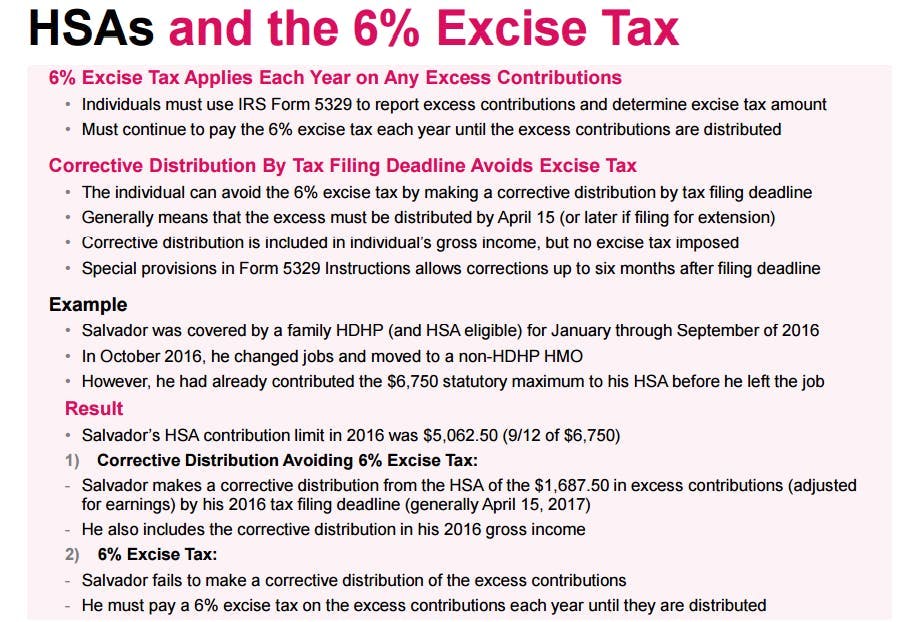

If the custodian will not return the excess contributions (which is unlikely), the employee will need make the corrective distribution from the HSA to avoid excise taxes on the excess contributions. This will need to be done by the due date for the employee’s tax return (generally April 15 if no extension) to avoid the 6% excise tax on the excess contributions.

The employer would need to include the amount of the excess contributions in the employee’s gross income as standard wages subject to withholding and payroll taxes (and report as such on the Form W-2).

Regulations

Newfront Office Hours: Go All the Way with HSA

Excess HSA Contributions

Excess HSA Contributions

IRS Notice 2008-59, Q/A-24:

https://www.irs.gov/pub/irs-drop/n-08-59.pdf

Q-24. If an employer contributes amounts to an employee’s HSA that exceed the maximum annual contribution allowed in § 223(b) due to an error, can the employer recoup the excess amounts?

A-24. If the employer contributes amounts to an employee’s HSA that exceed the maximum annual contribution allowed in § 223(b) due to an error, the employer may correct the error. In that case, at the employer’s option, the employer may request that the financial institution return the excess amounts to the employer. Alternatively, if the employer does not recover the amounts, then the amounts must be included as gross income and wages on the employee’s Form W-2 for the year during which the employer made contributions. If, however, amounts contributed are less than or equal to the maximum annual contribution allowed in § 223(b), the employer may not recoup any amount from the employee’s HSA.

IRS Notice 2004-2, Q/A-22:

https://www.irs.gov/irb/2004-02_IRB#NOT-2004-2

Q-22. What happens when HSA contributions exceed the maximum amount that may be deducted or excluded from gross income in a taxable year?

A-22. Contributions by individuals to an HSA, or if made on behalf of an individual to an HSA, are not deductible to the extent they exceed the limits described in A-12. Contributions by an employer to an HSA for an employee are included in the gross income of the employee to the extent that they exceed the limits described in A-12 or if they are made on behalf of an employee who is not an eligible individual. In addition, an excise tax of 6% for each taxable year is imposed on the account beneficiary for excess individual and employer contributions.

However, if the excess contributions for a taxable year and the net income attributable to such excess contributions are paid to the account beneficiary before the last day prescribed by law (including extensions) for filing the account beneficiary’s federal income tax return for the taxable year, then the net income attributable to the excess contributions is included in the account beneficiary’s gross income for the taxable year in which the distribution is received but the excise tax is not imposed on the excess contribution and the distribution of the excess contributions is not taxed.

IRS Publication 969:

http://www.irs.gov/pub/irs-pdf/p969.pdf

Excess contributions. You will have excess contributions if the contributions to your HSA for the year are greater than the limits discussed earlier. Excess contributions are not deductible. Excess contributions made by your employer are included in your gross income. If the excess contribution is not included in box 1 of Form W-2, you must report the excess as “Other income” on your tax return.

Generally, you must pay a 6% excise tax on excess contributions. See Form 5329, Additional Taxes on Qualified Plans (including IRAs) and Other Tax-Favored Accounts, to figure the excise tax. The excise tax applies to each tax year the excess contribution remains in the account.

You may withdraw some or all of the excess contributions and not pay the excise tax on the amount withdrawn if you meet the following conditions.

You withdraw the excess contributions by the due date, including extensions, of your tax return for the year the contributions were made.

You withdraw any income earned on the withdrawn contributions and include the earnings in “Other income” on your tax return for the year you withdraw the contributions and earnings.

IRS Form 5329 Instructions:

http://www.irs.gov/pub/irs-pdf/i5329.pdf

If you timely filed your return without withdrawing the excess contributions, you can still make the withdrawal no later than 6 months after the due date of your tax return, excluding extensions. If you do, file an amended return with “Filed pursuant to section 301.9100-2” written at the top. Report any related earnings for 2017 on the amended return and include an explanation of the withdrawal. Make any other necessary changes on the amended return (for example, if you reported the contributions as excess contributions on your original return, include an amended Form 5329 reflecting that the withdrawn contributions are no longer treated as having been contributed).

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn