ERISA Record Retention

By Brian Gilmore | Published November 3, 2017

Question: How long should an employer keep employee benefits records?

Compliance Team Response:

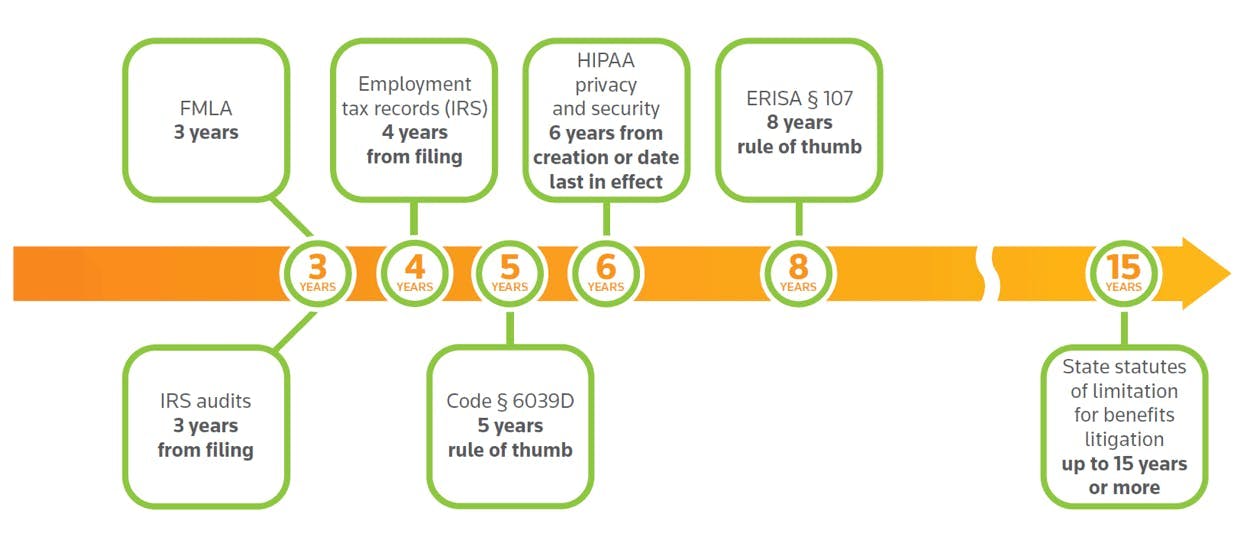

For employee benefit plan purposes, the general records retention rule of thumb is to keep ERISA-related records for eight years to comply with ERISA §107. There’s a nice chart of this rule below.

In short, ERISA requires that employers keep EB records for a period of a least six years after the filing date of the Form 5500 that is based on those records. Keeping records for eight years accommodates extended Form 5500 filings (which may be up to 9 ½ months after the end of the plan year), and provides a small cushion of additional time.

Regulations:

ERISA §107 [29 USC §1027] Retention of records.

Every person subject to a requirement to file any report (including the documents described in subparagraphs (E) through (I) of section 101(k)) or to certify any information therefor under this title or who would be subject to such a requirement but for an exemption or simplified reporting requirement under section 104(a)(2) or (3) of this title [29 USC §1024(a)(2) or (3)] shall maintain a copy of such report and records on the matters of which disclosure is required which will provide in sufficient detail the necessary basic information and data from which the documents thus required may be verified, explained, or clarified, and checked for accuracy and completeness, and shall include vouchers, worksheets, receipts, and applicable resolutions, and shall keep such records available for examination for a period of not less than six years after the filing date of the documents based on the information which they contain, or six years after the date on which such documents would have been filed but for an exemption or simplified reporting requirement under section 104(a)(2) or (3) [29 USC §1024(a)(2)or (3) ].

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn