Self-Funding: Gain Long-Term Stability with a Benefits Captive

By Paul Martinez | Published July 14, 2021

As health insurance costs continue to rise on an annual basis, averaging 5.5% each year, 7.0% for 2021, and 6.5% for 2022 due to the direct and indirect effects of COVID-19, you may be wondering how do you stay ahead of the market, and gain stability in such a volatile market? The solution for many large employers has long been self-funding, as it provides many advantages including:

Flexibility in customizing the plan to employers’ goals and employees needs

Control of selecting and coordinating plan best in class point solution partners

Less fixed costs due to lower profit and risk margins taken by the insurer

No state-levied premium taxes

The employer health plan isn’t subject to state insurance laws and mandates

Stop loss insurance to protect and mitigate the cost of large claims.

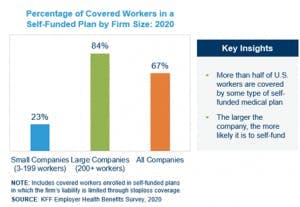

In fact, more than 80% of large companies with 200 or more U.S. workers are covered by some type of self-funded medical insurance plan.

However, many small to medium sized organizations with 50-400 employees haven’t been able to gain the significant advantages that self-funding provides as the volatility and likelihood of large claims outweighs their appetite to participate. But they can benefit as well through a use of a group captive.

But how exactly does an employee benefit captive even work?

Said simply, a captive is based on the fundamentals of insurance. Captives pool small to mid-size employers together to stabilize and cap the employers risk when self-funding. By participating in a captive, you enter a group of like-minded employers that pool their stop loss premium into a collective fund. By doing so, a captive can reduce the reinsurance premium volatility that small to medium sized organizations would face if they were self-funding on their own. Being part of a captive allows the experience of a standalone, self-funded plan but amplifies the benefits, as each employer benefits from the economies of scale and gains access to data analytics, manageable stop loss levels, and vendor pricing.

Typically, each employer contributes anywhere from 15% to 35% of their total healthcare spend for large and catastrophic claims via premiums to the stop loss carrier and captive. The captive or carrier then pays the large claims, and employers use the rest of their healthcare spend to pay for their broker, third-party administrator, a network partner (e.g., United Healthcare), and any smaller, more predictable claims. If the captive runs better than expected, the employer receives their share of the captive profits. If the smaller claims don’t happen, then the money never leaves their control. Because it’s much easier to predict claims for a large employer than for a small to mid-size employer, the captive is able to reduce the year-over-year volatility the small to medium sized employer could experience on their own.

A group captive benefit plan provides so many benefits, including stability, control, transparency, opportunity, and overall improved cost efficiencies, however, it is imperative that the ‘like-minded’ attitude comes into play, as this is the most critical element for success. Each member must value the fundamental advantages of self-funding and understand that going into a captive arrangement is not something that you just try out for a year. It is a commitment. This is more than a one-year purchase, check-the-box and done approach, but a long-term commitment with members who are seeking long-term stability in healthcare costs. For example, if we look at the following case study it illustrates the long-term savings potential.

Growing manufacturer and distributor company, seeing double digit increases in premiums year-over-year.

Moved to a benefits captive to understand what’s driving their renewal increases and develop a strategy to control the driver.

Discovered cancer claims are the root of their insurance increases

Implemented a cancer care program to enhance the member experience with their treatment while reducing their costs

Redesigned their pharmacy drug program to reduce their pharmacy cost without removing drugs from their formulary list

Results:

Paul Martinez

Executive Vice President

Paul focuses on helping companies scale from startup mode to global/public organizations, advising them on their risk, plan design, and compliance for their employee benefit programs at each growth stage. He transitioned into the total rewards space in 2010 after managing a Wells Fargo Financial office in Portland, Oregon. He uses his financial background to provide actuarial-based consultations and create forward-thinking solutions for companies to break the status quo on annual health insurance increases.