Dependent Care FSA During Maternity Leave

By Brian Gilmore | Published May 17, 2019

Question:

Are an employee’s daycare/nanny costs eligible for reimbursement under the dependent care FSA when the employee’s spouse is a new birthing mother who is disabled while on maternity leave?

Compliance Team Response:

Dependent Care Expenses Must be “Employment-Related”

Employees’ dependent care expenses are eligible for reimbursement under the dependent care FSA only if the expenses are “employment-related,” which means they enable the employee and spouse to be gainfully employed.

If an employee is married, dependent care expenses will qualify as “employment-related” only if:

The employee’s spouse is gainfully employed;

The employee’s spouse is in active search of gainful employment;

The employee’s spouse is a full-time student; or

The employee’s spouse is mentally or physically incapable of self-care with the same principal place of abode as the employee for more than half the year.

Dependent Care FSA “Incapable of Self-Care” Test

The test for whether an individual is incapable of self-care presents a higher bar than a standard disability determination for other purposes, such as for disability benefit purposes.

An individual is considered physically or mentally incapable of self-care only if, as a result of a physical or mental defect, the individual is incapable of caring for his or her hygiene or nutritional needs, or requires the full-time attention of another person for the individual’s own safety or the safety of others. The IRS summarizes this standard as “Persons who can’t dress, clean, or feed themselves because of physical or mental problems.”

Regulations further confirm that the inability of the individual to “perform the normal household functions of a homemaker or care for minor children by reason of a physical or mental condition does not of itself establish that the individual is physically or mentally incapable of self-care.”

An employee whose spouse is disabled from working and receiving disability benefits cannot continue to claim daycare expenses unless the spouse’s disability rises to this stricter “incapable of self-care” standard. It is likely that most new birthing mothers don’t meet this standard despite being considered disabled for multiple other purposes (FMLA, CFRA, SDI, STD, etc.).

Determining Eligible Expenses

Ultimately, the determination as to whether the child’s expenses are eligible for reimbursement under the dependent care FSA is an individual income tax issue to be resolved by the employee through assistance with the employee’s personal tax advisor. Where in question, the employee should consult a personal tax advisor for assistance determining whether the spouse meets this definition.

The dependent care FSA will require the employee to certify that the expenses are eligible for reimbursement upon submitting a claim. Unless the administrator has reason to believe that a participant does not qualify for reimbursement, there will be no further inquiry made by the administrator. The issue would come up for the employee only if raised on audit of the individual tax return by the IRS.

Employee May Drop Dependent Care Upon Spouse’s Maternity Leave Start, and Re-Enroll Upon Spouse’s Return to Work

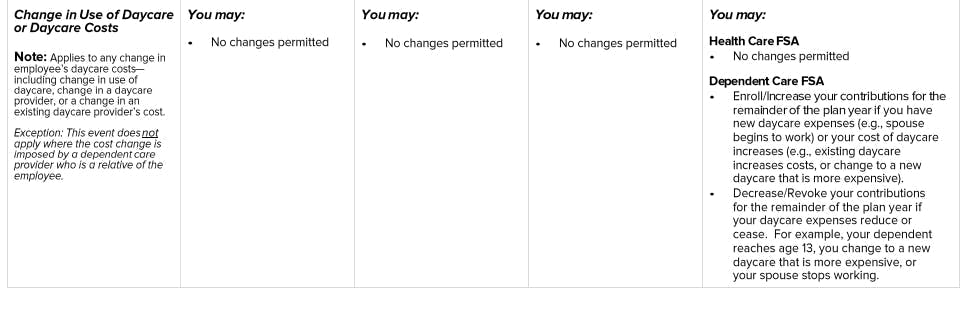

Employees may change their dependent care FSA election upon experiencing any change in the use of daycare, change in daycare provider, or a change in an existing daycare provider’s costs.

Upon an employee’s spouse beginning maternity leave, the employee may choose to revoke the dependent care FSA election because the employee will no longer have eligible expenses for reimbursement. The employee may then elect to re-enroll in the dependent care FSA upon the spouse’s return to work because the daycare expenses will again become eligible for reimbursement.

Employee May Continue Contributions During the Maternity Leave

The employee could choose to continue contributions to the dependent care FSA for the period during which the employee has no reimbursable expenses because the spouse is not working and does not meet the “incapable of self-care” test for these purposes. Employees often make that decision so they will have the funds available to reimburse daycare expenses when the spouse returns to work (or to cover eligible expenses incurred prior to the start of the spouse’s leave).

In other words, although the employee’s current day care-related costs may not reimbursable under the dependents care FSA during the spouse’s leave, the employee can continue making the regular contribution in anticipation of later-year expenses that will qualify for reimbursement (or to reimburse prior eligible expenses).

More Information on Eligible Dependent Care FSA Expenses

Regulations

Treas. Reg. §1.21-1(b)(4):

(4) Physical or mental incapacity. An individual is physically or mentally incapable of self-care if, as a result of a physical or mental defect, the individual is incapable of caring for the individual’s hygiene or nutritional needs, or requires full-time attention of another person for the individual’s own safety or the safety of others. The inability of an individual to engage in any substantial gainful activity or to perform the normal household functions of a homemaker or care for minor children by reason of a physical or mental condition does not of itself establish that the individual is physically or mentally incapable of self-care.

IRS Publication 503:

https://www.irs.gov/pub/irs-pdf/p503.pdf

Physically or mentally not able to care for oneself._ Persons who can’t dress, clean, or feed themselves because of physical or mental problems are considered not able to care for themselves. Also, persons who must have constant attention to prevent them from injuring themselves or others are considered not able to care for themselves._

IRS Tax Topic 602:

https://www.irs.gov/taxtopics/tc602

Qualifying Individual

A qualifying individual for the child and dependent care credit is:

Your dependent qualifying child who is under age 13 when the care is provided,

Your spouse who is physically or mentally incapable of self-care and lived with you for more than half of the year, or

An individual who is physically or mentally incapable of self-care, lived with you for more than half of the year, and either: (i) is your dependent; or (ii) could have been your dependent except that he or she has gross income that equals or exceeds the exemption amount, or files a joint return, or you (or your spouse, if filing jointly) could have been claimed as a dependent on another taxpayer’s 2017 return.

Physically or Mentally Not Able to Care for Oneself – An individual is physically or mentally incapable of self-care if, as a result of a physical or mental defect, the individual is incapable of caring for his or her hygiene or nutritional needs, or requires the full-time attention of another person for the individual’s own safety or the safety of others.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn