Combined Dependent Care FSA Contributions in Excess of $5000

By Brian Gilmore | Published September 29, 2017

When both spouses contribute to Dependent Care Spending Accounts they must take care not to exceed the IRS limit.

Question: An employee recently realized that his combined dependent care FSA elections with his spouse will exceed $5,000 for the current calendar year. Can the employee change his election mid-year to avoid the excess contributions?

Compliance Team Response:

Option to Permit Dependent Care FSA Election Reduction or Revocation on Prospective Basis

The company may permit an employee to reduce or revoke a dependent care FSA election on a prospective basis to avoid exceeding the $5,000 combined limit for spouses.

Employers are not required to permit an employee to change the dependent care FSA election in these circumstances, but in our experience most employers offer the option to reduce or revoke the election where this situation arises.

This option to reduce or revoke the election stems from the informal IRS guidance cited below. That guidance suggests that the company should ask for some form of documentation from the employee demonstrating that the spouse also elected to contribute to his or her dependent care FSA (causing the potential excess) in order to process the election change.

Potential Excess Amounts Will Be Converted to Taxable Income on Individual Tax Return

If the employee’s combined dependent care FSA contributions nonetheless end up exceeding the $5,000 limit, the excess will be reported by the employee when filing the individual tax return (Form 1040).

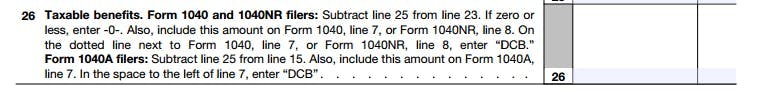

As part of the individual tax return, the employee will complete Form 2441. This is the mechanism for the IRS to catch any excess contributions (sometimes referred to as “double-dipping”). On the Form 2441, the employee will be asked a series of questions regarding DCAP contributions. The form then computes the amount of any excess DCAP contributions, which must be reported as taxable income on the Form 1040. It further directs the individual to write “DCB” (dependent care benefits) next to that line item on the Form 1040 (cite below).

There is no penalty associated with this process. The excess amounts are merely converted to taxable income. The employee would not lose the excess contribution.

Regulations:

ABA, JCEB Q&A:

7§ 125, § 129 – Dependent Care Expense Reimbursement Under a Cafeteria Plan

The husband of a married couple works at Corporation A and his wife works at Corporation B. Corporation A and Corporation B each maintain a calendar-year cafeteria plan that allows eligible employees to elect to have up to $5,000 deducted from pay and contributed to a dependent care reimbursement account under a cafeteria plan. At open enrollment, both the husband and wife elect to have $5,000 deducted from pay to be contributed to the dependent care reimbursement account under the applicable cafeteria plan. After the start of the calendar year, the husband and wife realize that they have elected to have too much contributed to a dependent care reimbursement account. May one spouse (either the husband or wife) ask the applicable employer to revoke that spouse’s election to have $5,000 deducted from pay to be contributed to the dependent care reimbursement account?

Proposed Response: One spouse may ask the applicable employer to revoke the election, if that spouse documents that each of the spouse’s elected to have $5,000 deducted from pay to be contributed to the dependent care reimbursement account. This is permitted because the spouses made a mistake of fact regarding the maximum amount that may be reimbursed under Code § 129. Also, allowing an employer to cancel the election assures the proper FICA and FUTA taxes are imposed. Although a spouse’s employer may allow the spouse to cancel such an election, the employer is not required to cancel the election.

IRS Response: The Service representative agrees with the proposed response.

Form 2441:

https://www.irs.gov/pub/irs-pdf/f2441.pdf

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn