Cafeteria Plan Nondiscrimination Tests

By Brian Gilmore | Published February 14, 2020

Question: What are the cafeteria plan nondiscrimination tests, and what is the definition of highly compensated for each?

Short Answer: Each component of the cafeteria plan has a different set of nondiscrimination tests and the definition of highly compensated.

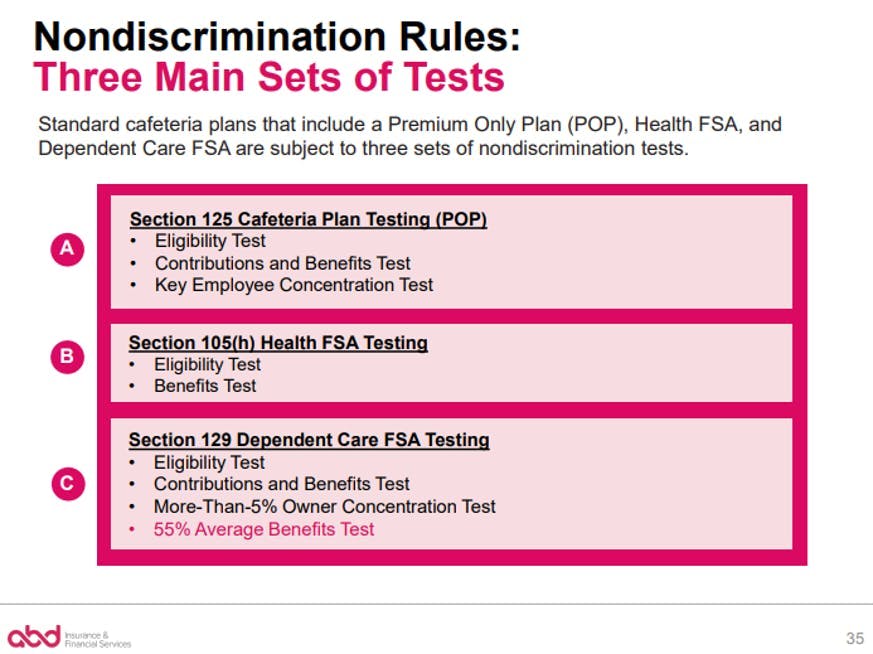

Cafeteria Plan Nondiscrimination Testing (§125)

a) Nondiscrimination Test Components

Eligibility Test

Contributions and Benefits Test

Key Employee Concentration Test

b) Cafeteria Plan NDT: Highly Compensated Participant (HCP)

Individuals are considered highly compensated as a HCP for purposes of the Eligibility Test and the Contributions and Benefits Test if they are:

An officer;

A more-than-5% owner of the employer in the current or preceding year; or

An employee who earned in excess of $125,000 (2020 testing) or $130,000 (2021 testing) in the prior plan year, or current plan year in the case of the first year of employment (Note: Top 20% alternative may be available via top-paid group election).

c) Cafeteria Plan NDT: Key Employees

Individuals are considered highly compensated as a Key Employee for purposes of the Key Employee Concentration Test if they are:

An officer with annual compensation for the current plan year in excess of $185,000 (2020 testing);

A more-than-5% owner; or

A more-than-1% owner making at least $150k (all testing years).

Health FSA Nondiscrimination Testing (§105(h))

a) Nondiscrimination Test Components

Eligibility Test

Benefits Test

b) Health FSA NDT: Highly Compensated Individual (HCI)

Individuals are considered highly compensated as a HCI for purposes of §105(h) if they are:

One of the top five highest-paid officers;

A shareholder who owns more than 10% of the value of the employer’s stock; or

Among the highest-paid top 25% of all employees in the current plan year.

Dependent Care FSA Nondiscrimination Testing (§129)

a) Nondiscrimination Test Components

Eligibility Test

Contributions and Benefits Test

More-Than-5% Owner Concentration Test

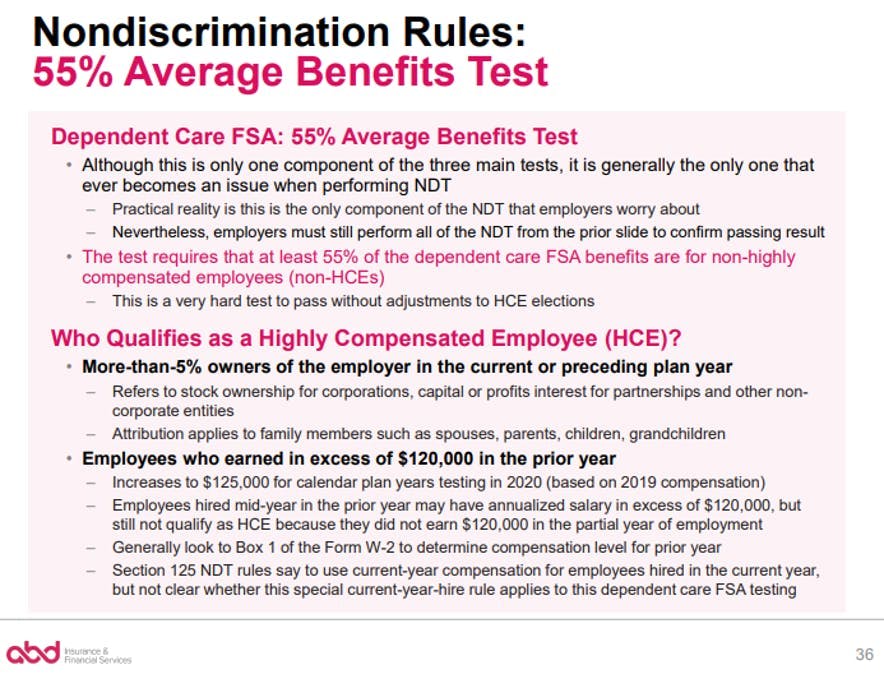

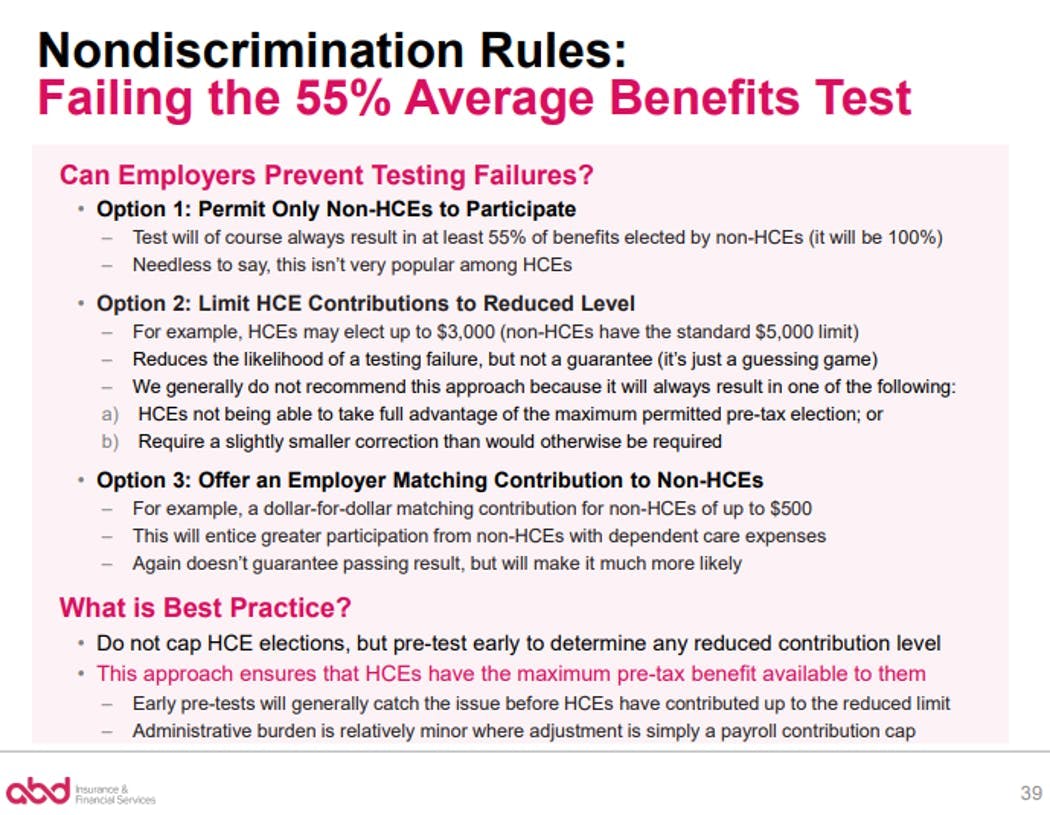

55% Average Benefits Test (Most Common NDT Failure)

b) Dependent Care FSA NDT: Highly Compensated Employee (HCE)

Individuals are considered highly compensated as an HCE for purposes of the dependent care FSA NDT if they are:

A more-than-5% owner of the employer in the current or preceding plan year; or

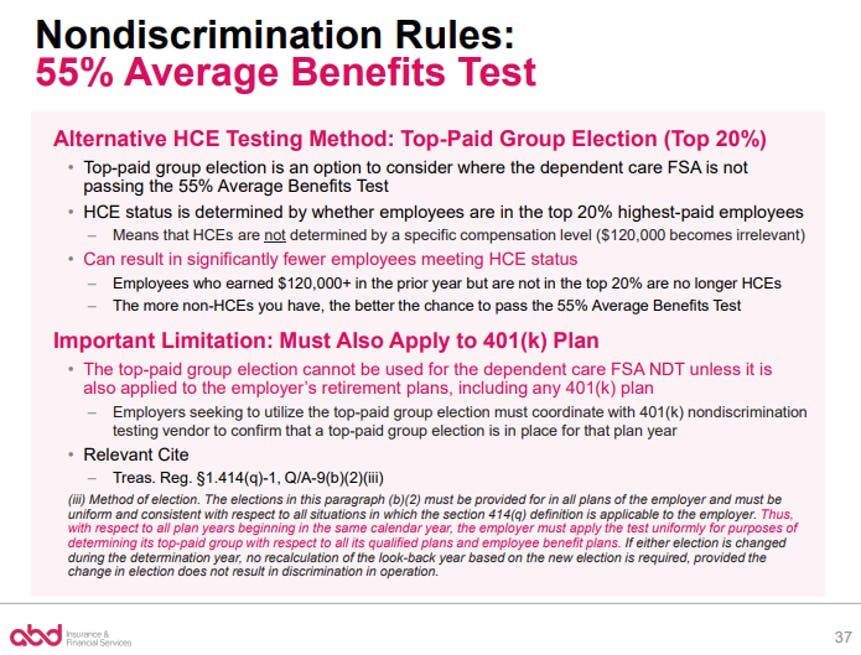

An employee who earned in excess of $125,000 (2020 testing) or $130,000 (2021 testing) in the prior plan year (Note: Top 20% alternative may be available via top-paid group election).

For more details on various nondiscrimination testing issues:

For more details of everything related to cafeteria plans, see our Office Hours Webinar: Section 125 Cafeteria Plans.

Regulations

Office Hours Webinar: Section 125 Cafeteria Plans

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn