401(k)ology – Correcting “De minimis” Plan Errors

By Joni L. Jennings, CPC, CPFA®, NQPC™ | Published February 14, 2023

What is a de minimis error or amount as it relates to mistakes in operating a retirement plan? According to the dictionary definition, “de minimis” pertains to trivial or insignificant things**. In relation to a qualified retirement plan, these de minimis errors are small amounts that are either erroneously deposited to a participant’s account or that are erroneously distributed to a participant. Correcting retirement plan errors falls under the purview of the Internal Revenue Service (“IRS”), specifically detailed in Revenue Procedure 2021-30, the Employee Plans Compliance Resolution System (“EPCRS”). While EPCRS provides a roadmap for correcting de minimis errors, it can be confusing to plan sponsors and practitioners. **In other words, the directions are clear as mud.

The Employee Plans Compliance Resolution System (“EPCRS”) allows plan sponsors to self-correct operational failures within a reasonable time after the error occurs, known as the correction period. For most operational failures, the correction period ends on the last day of the third plan year following the year that the failure occurred; however, SECURE 2.0 expanded the timeframe to correct inadvertent errors that occur in day-to-day operation of the plan. Even with a reasonable amount of time permitted to correct errors, every attempt should be made to correct them as soon as practical to prevent the IRS from discovering the error first.

There are a few basic correction principles under EPCRS. Corrections must be reasonable, should restore the plan to a position had the error not occurred, and should resemble one of the examples provided in EPCRS.

Employers often question the need to self-correct errors that involve small amounts. What is meant by the term “de minimis,” and is there a reasonable “small amount” that does not require the plan sponsor to make a correction to a participant’s account or to a distribution overpayment? Let’s face it, no one wants to spend the time to determine the earnings on $12.23 of excess match that was deposited to a participant’s account in a plan that has thousands of participants.

Can the excess remain in the participant's account? Good question! Let’s review some key terms and the correction methods that apply.

Key Terms included in EPCRS:

Excess Amount – An Excess Amount is a qualification failure due to a contribution made to a participant’s account. A qualification failure occurs when either a statutory or plan limit is exceeded. Specifically, elective deferrals in excess of the IRC §402(g) limit, elective deferrals or after-tax contributions in excess of a plan limit, contributions in excess of the §415 Annual Additions limit, excess contributions or excess aggregate contributions due to a failed ADP/ACP test and contributions allocated on compensation in excess of the annual dollar limit under §401(a)(17). Excess Amounts are not eligible for favorable tax treatment and cannot be rolled over to another plan or IRA. Excess Amounts are qualification failures that may jeopardize the tax favored status of the plan if uncorrected.

Small Excess Amount - If there is a Small Excess Amount (qualification failure under $250), the plan sponsor is NOT required to distribute or forfeit the Excess Amount. The plan Sponsor is required to notify the participant that the Small Excess Amount (adjusted for earnings) is not eligible to be rolled over to an IRA or other qualified plan. NOTE: If the Small Excess Amount is not distributed or forfeited, there will be a portion of the participant’s account that is not eligible for tax-free rollover and that basis plus earnings must be tracked. For that reason, any Small Excess Amount that remains in the plan **should **be distributed or forfeited. If the participant has already been paid out of the plan, the plan sponsor must notify the participant of the amount that was not eligible for rollover (including earnings).

Excess Allocation - An Excess Allocation is an Excess Amount that does not have a specific correction method under the Internal Revenue Code or the regulations. In other words, there is not a qualification failure (noted in item #1 above) but there was too much deposited to a participant’s account. Excess Allocations that involve employer contributions are either reallocated to participants or forfeited (including earnings). Excess Allocations of employee deferrals or after-tax contributions must be distributed to the participant (including earnings). Excess Allocations of deferrals or after-tax contributions are common in payroll deduction errors when an employee elects a certain dollar or percentage, but the deduction exceeds the election of the participant.

Small Excess Allocations – Small Excess Allocations are Small Excess Amounts that do not involve a qualification failure. If there is Small Excess Allocation of **employer **contributions, the excess allocation is not required to be distributed or forfeited if the total amount is less than $250. As noted above, Excess Allocations of employee deferrals or after-tax contributions must be distributed to the participant – there is not a de minimis amount for employee contributions.

Distribution Overpayments – Excess that is distributed to a participant, that the participant was not entitled to receive. The correction for overpayments depends on whether the amount was an Excess Amount or an Excess Allocation and whether the overpayment was in excess of $250.

**Distribution of Small Benefits **– If, after a corrective allocation has been made to the plan, former participants end up with small balances under $75 (or the applicable distribution fee, if less), the plan sponsor is not required to process the distribution. The small balance may be forfeited and used according to the plan’s terms.

Best Practices: Any amount that exceeds a statutory or plan limit that remains in the plan should be corrected by either a refund to the participant or forfeiting the excess. Small Excess Amounts (under $250), while not required to be corrected, create a basis in the participant’s account that must be tracked because they are not eligible for rollover.

Thresholds for Correction – What is De Minimis and When does it Apply?

While there is a general $250 de minimis rule, it does not apply in all situations. Interestingly, EPCRS provides a $250 de minimis exception for both Excess Amounts and Distribution Overpayments, but not Excess Allocations.

Does the de minimis exception apply or is a correction required when too much is deposited to a participant’s account?

**Excess Deferral/After-Tax Contributions: **If the excess is due to elective deferrals (pre-tax or Roth) or employee after-tax contributions, the correction is to refund the excess to the participant (adjusted for earnings). An example would be the employee elected 10% for deferrals but the employer withheld 18%. The 8% excess must be returned to the employee with earnings—regardless of whether the employee subsequently approves of the excess.$250 De Minimis Application: The $250 de minimis rule would apply to avoid the need to correct the excess if the excess amount exceeded a plan limit, but not a statutory limit. For example, if the plan provides that deferrals will be implemented in accordance with participant elections, the excess allocation would also qualify as an excess amount subject to the de minimis exception.

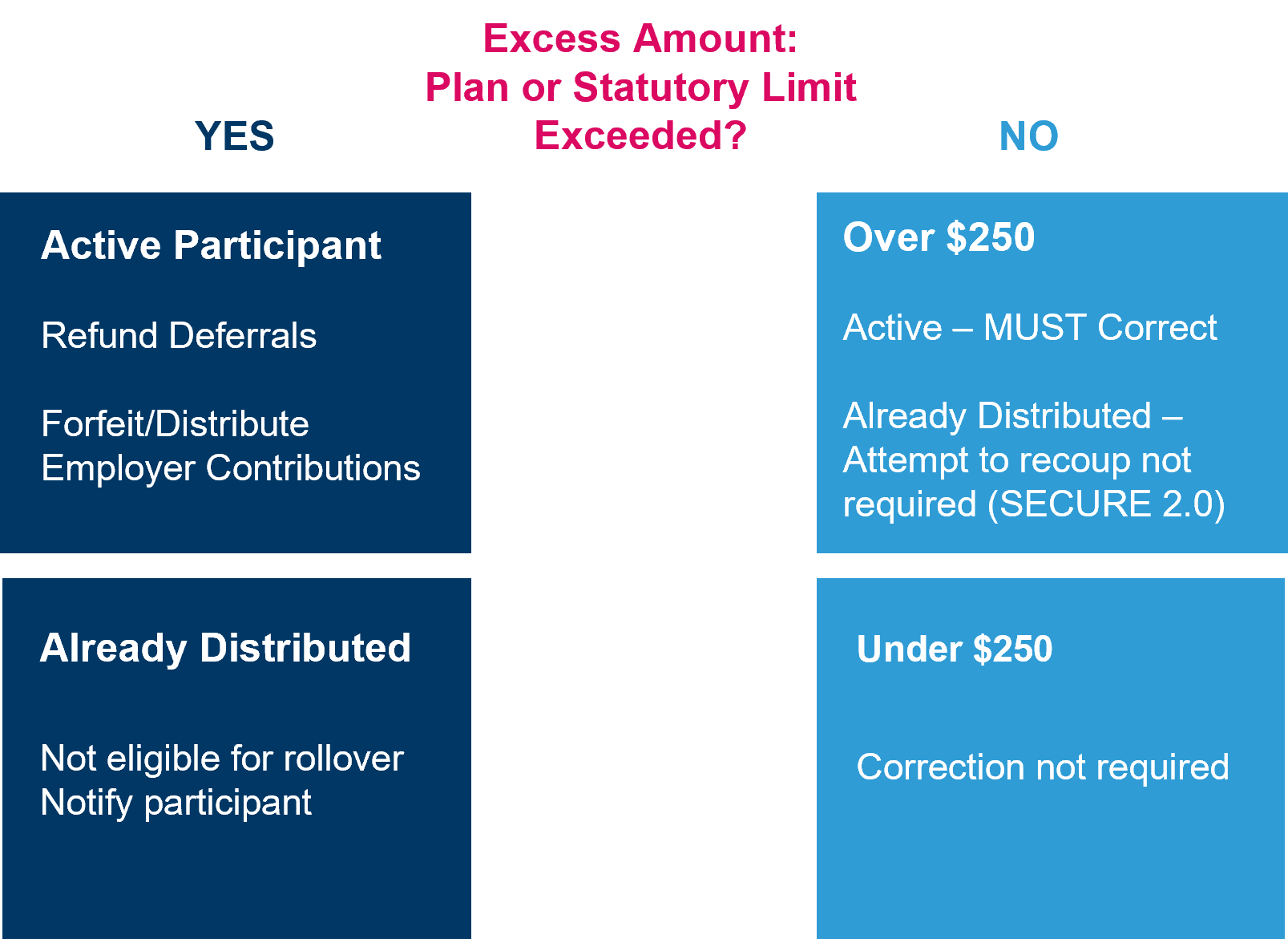

Excess Amount (Contribution Exceeding Statutory or Plan Limit): If an “Excess Amount” is due to a statutory or plan limit being exceeded (§415 annual additions limitation, §402g limit, contributions allocated on compensation in excess of the annual dollar limit, etc.), the excess is corrected by distribution of the excess or by forfeiture. $250 De Minimis Application: The $250 de minimis rule applies to “small excess amounts,” avoiding the need to distribute or forfeit where the excess amount is $250 or less. However, if the excess exceeds a statutory limit, the employer must notify the participant that the excess (including gains) is not eligible for favorable tax treatment (and specifically is not eligible for rollover).

**Excess Allocation (Contribution With No Corrective Method): **The Excess Allocation is corrected by distribution of the excess or by forfeiture.$250 De Minimis Application: The $250 de minimis rule does not apply to excess allocations, so there is not a de minimis exception in this situation.

Excess Amount Already Distributed (Overpayment): If a participant had an “Excess Amount” which was already distributed, the employer must seek repayment and notify the participant that the Excess Amount was not eligible for rollover and the Excess Amount must be reported on Form 1099-R.$250 De Minimis Application: If the overpayment is $250 or less, the employer is not required to seek return of the overpayment or notify the employee that the excess is not eligible for favorable tax treatment (and specifically is not eligible for rollover).

**Excess Allocation Already Distributed (Overpayment): **If the participant had an “Excess Allocation” (e.g., excess inadvertently deposited to participant’s match account but does not exceed any statutory or plan limits), the plan sponsor should request that the participant repay the excess (plus earnings). If the participant does not repay the excess, the plan sponsor must make the plan whole by repaying the excess to the plan’s forfeiture or unallocated account to be used toward future employer contributions. The plan sponsor should notify the participant that the excess was not eligible for rollover and may require corrections to Form 1099-R.$250 De Minimis Application: If the overpayment is $250 or less, the employer is not required to seek return of the overpayment or notify the employee that the excess is not eligible for favorable tax treatment (and specifically is not eligible for rollover).

What impact did SECURE 2.0 have?

Section 3.01 of SECURE 2.0 broadened the recoupment of overpayments involving Excess Allocations of employer contributions that are greater than $250. If a participant takes a distribution and that distribution includes an Excess Allocation, plan fiduciaries are not required to seek repayment of the overpayment and the rollover preserves its tax qualified status. Note that this does not apply if there was a qualification failure (e.g., §415 excess). The plan sponsor is still required to make the plan whole by repaying the excess to the plan’s forfeiture or unallocated account.

Unfortunately, the same forgiveness does not apply when there is an Excess Allocation, and the participant is still active in the plan (still has a balance). In that case, if it is over $250, it must either be distributed to the participant or forfeited.

Distribution of Small Accounts - $75 or less

Plan sponsors are not required to distribute small accounts that may be generated after a corrective allocation was made to participants who have already been paid out or who are terminated with a zero balance at the time of the corrective allocation.

Under self-correction, corrective contributions (allocations) are required to be made to all participants affected by the correction according to the plan terms or EPCRS, regardless of the amount owed or the employment status of the participant. Oftentimes, former employees will be allocated a small amount (because the correction must follow the plan terms) and there will be numerous former employees with balances under $75.

If the distribution fee is greater than the amount owed the former participant or is less than $75, the plan sponsor need not process the distribution. In that circumstance, the corrective contribution is deposited to the participant’s account and may subsequently be forfeited. The funds remain in the plan and may be used according to the applicable forfeiture provisions in the plan document.

Example:

Upon review of the operation of the plan for the 2021 plan year, it is discovered that plan compensation was not correctly applied in determining the employer matching contributions that were funded on a per pay period basis. The plan document does not exclude commissions; however, in operation the commission payments were not included in determining the match. The correction is a corrective allocation to all affected participants for the 2021 plan year.

The error was not discovered until July 2022 and there are numerous former participants affected by the correction who no longer have an account balance in the plan. The amount due each participant must be deposited to their accounts. The plan sponsor is not required to process subsequent distributions to former participants if the amount credited to the account of each of the affected former participants is less than $75. Once the corrective allocation has been deposited, the small accounts less than $75 may be forfeited.

**Practical Note: ** If the distribution processing fee exceeds the amount owed to the participant, no distribution is required. This makes sense from a practical standpoint and relieves the plan sponsor from an administrative headache after making required corrections to the plan.

Flowchart of De Minimis Corrections

Note: EPCRS permits plan sponsors to correct most operational failures through self-correction. To self-correct, there must be established policies and procedures in place to prevent operational failures, the correction methods should resemble those provided in EPCRS, the corrections should be made as soon as practical after discovery, and the correction should be documented in the plan’s permanent plan records.

Conclusion

Despite best efforts, operational errors occur quite frequently in the day-to-day administration of retirement plans. EPCRS provides the general principles for correcting these errors when they do occur. The key to operating a compliant plan → Find it, fix it, and document it.

Newfront’s Retirement Services team is available to assist you with questions regarding plan corrections or other retirement plan questions that may arise. Email us today!

Helpful Quick Links

Joni L. Jennings, CPC, CPFA®, NQPC™

Chief Compliance Officer, Newfront Retirement Services, Inc.

Joni Jennings, CPC, CPFA®, NQPC™ is Newfront Retirement Services, Inc. Chief Compliance Officer. Her 30 years of ERISA compliance experience expands value to sponsors of qualified retirement plans by offering compliance support to our team of advisors and valued clients. She specializes in IRS/DOL plan corrections for 401(k) plans, plan documents and plan design.