401(k)ology - The Missed Deferral Opportunity

By Joni L. Jennings, CPC, CPFA®, NQPC™ | Published April 25, 2022

A missed deferral opportunity arises when an eligible employee should have had elective deferrals withheld from compensation; however, due to an oversight in plan operation, the correct amount was not deducted and remitted to the plan. Common Missed Deferral Opportunities (“MDO”) arise in the following situations:

Failure to apply a deferral election to the correct compensation

Failure to implement a deferral election

Failure to enroll an eligible employee or apply automatic enrollment

We have identified a Missed Deferral Opportunity, now what?

The good news is that MDOs are fairly common in elective deferral plans and the IRS has a correction program that assists plan sponsors with correcting these operational failures. The amount of the correction depends on the type of plan and the timing of the MDO.

In most situations, the Employee Plans Compliance Resolution System (ECPRS) allows the plan sponsor to self correct MDOs (meaning that a formal submission to the IRS is not needed). In more egregious situations, or if the operational failure occurred over many plan years and affected a large number of participants, the correction may need to be submitted to the IRS for formal approval.

The key is to follow the IRS’ correction methods, noting here that doubling up on deferrals is not permitted unless the employee elects to do so prospectively.

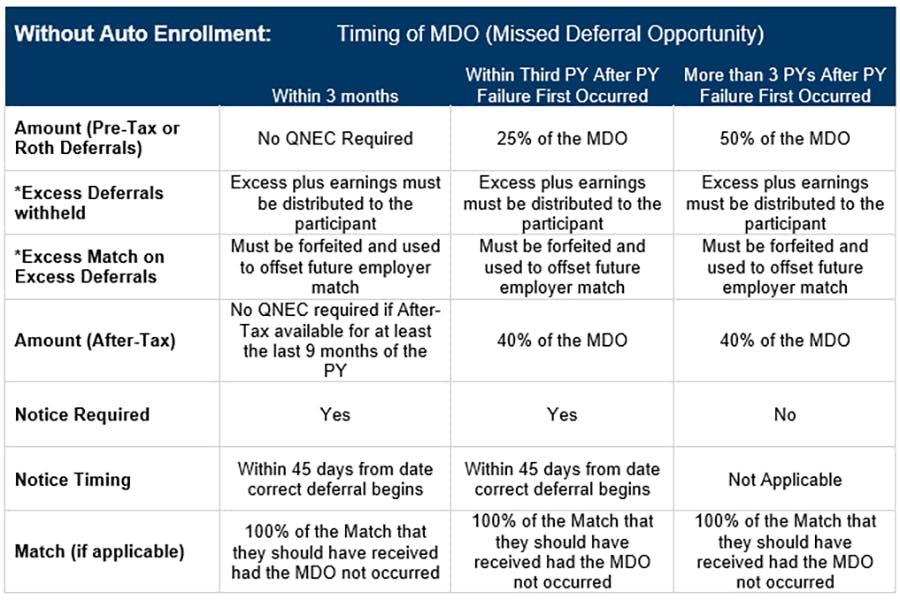

Plans Without Automatic Enrollment

Below is a quick summary of the corrections by timeframe and the amount (if required) of the corrective contribution (referred to as a “QNEC”):

In order to use the reduced QNEC (0% or 25%) when a participant notifies the employer of the oversight, the employer must begin the correct deferral withholding as soon as possible but no later than the first pay period in the month following the month end in which the employee notified the employer. Secondly, the employer must provide the affected participant the notice within 45 days from the date the correct withholding starts. If either of these conditions is not met, the QNEC is 50% of the MDO.

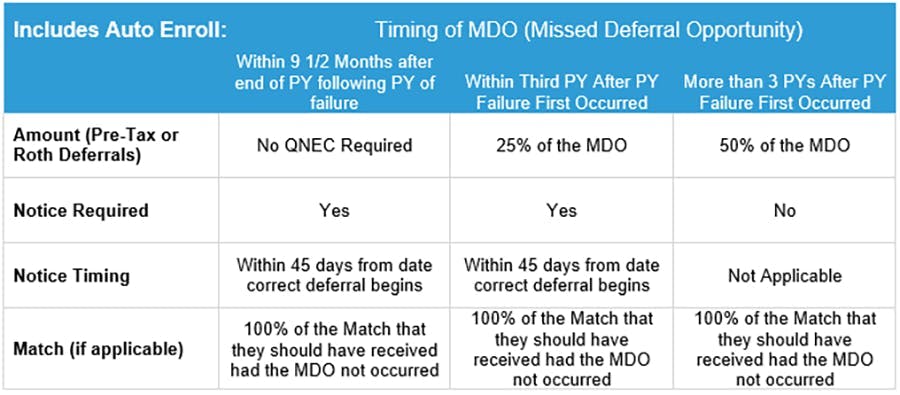

Plans that Include Automatic Enrollment

If your plan includes an automatic enrollment feature, there is an extended timeframe for correcting missed deferral opportunities:

What About Missed Earnings?

If a QNEC is required (for either type of plan) earnings must be added to the corrective contribution to make the participant whole. Earnings are calculated from the date of the failure to the end of the plan year in which the failure occurred. Then, the principle plus the earnings become the new basis for the following year's calculation of earnings (if applicable).

What is required to be in the Notice?

A notice must be provided to each affected participant when taking advantage of the reduced 25% or 0% QNEC options for a short-duration MDO, as described above. Below are the contents of the notice:

The percentage or dollar amount of plan compensation that should have been deferred

The date the deferral election should have been implemented

The date the correct withholding began

If applicable, a statement that the plan sponsor will be/has made corrective contributions

A statement that the employee can adjust their future withholding

A statement that any applicable matching contributions have been/will be made

The Plan Name and Contact Information

**Conclusion **

If you have discovered that your plan has an operational failure, the first thing you should do is to contact your retirement advisor to help navigate you through the process. Our team at Newfront is available to assist you with any questions regarding missed deferral opportunity corrections or other plan operational matters that may arise.

Helpful Quick Links

EPCRS Rev. Proc. 2021-30IRS 401(k) Fix-It Guides - MDO CompensationIRS Fix-It Guide - MDO Excluded an Eligible Employee

Joni L. Jennings, CPC, CPFA®, NQPC™

Chief Compliance Officer, Newfront Retirement Services, Inc.

Joni Jennings, CPC, CPFA®, NQPC™ is Newfront Retirement Services, Inc. Chief Compliance Officer. Her 30 years of ERISA compliance experience expands value to sponsors of qualified retirement plans by offering compliance support to our team of advisors and valued clients. She specializes in IRS/DOL plan corrections for 401(k) plans, plan documents and plan design.