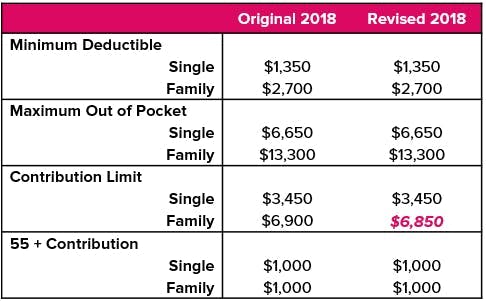

2018 HSA Family Contribution Limit Reduced to $6,850

By Brian Gilmore | Published March 7, 2018

Yesterday, the IRS released Revenue Procedure 2018-18 to reflect modified inflation-adjusted figures under the Tax Cuts and Jobs Act (TCJA) passed at the end of 2017. The new approach under the TCJA uses a slightly different Chained CPI calculation for such adjustments.

The result is the that IRS has revised downward the 2018 family HSA contribution limit from $6,900 to $6,850.

No other HDHP or HSA limit was modified.

Modifying 2018 Family HSA Elections

Employers with benefit administration systems will need to work with the system administrator to revise the maximum family limit in the system, and recalculate deductions for any employee who had elected to contribute up to the original $6,900 limit.

Corrective Action Where Already Contributed $6,900

Employers that already contributed $6,900 to an employee’s HSA will want to take corrective action by requesting the HSA custodian return the excess contribution to the employer before the end of 2018 to avoid adverse tax consequences for the affected employees.

See slide 45 of our Office Hours webinar Go All the Way with HSA for complete details.

Adoption Assistance Programs Also Affected

Revenue Procedure 2018-18 also reduces the 2018 maximum employer-provided adoption assistance program exclusion amount from $13,840 to $13,810.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn