2016 San Francisco HCSO Annual Reporting Form Released with a May 1 Filing Deadline

By Karen Hooper | Published April 11, 2017

2016 San Francisco HCSO Form Released

If you are a San Francisco employer, you have an extra day to file your 2016 Health Care Security Ordinance (HCSO) Annual Reporting Form. Since April 30th falls on a Sunday, the due date for this filing is May 1, 2017.

How do you know if you need to file?

You are a covered employer and are required to file if you met the following three conditions in 2016:

employed one or more workers within the geographic boundaries of the City and County of San Francisco;

were required to obtain a valid San Francisco business registration certificate pursuant to Article 12 of the Business and Tax Regulations Code, and

employed 20 or more persons worldwide (for profit) or a nonprofit organization that employed 50 or more persons worldwide.

**Below are links to the necessary information. **

PDF Preview of 2016 Annual Reporting Form

Instructions to complete the Annual Reporting form

The penalty for failure to submit the form is $500 for each quarter that the violation occurs.

Some of the key information required to be completed in the report include:

San Francisco Business Account Number

Total number of employees in each quarter (nationwide)

Number of employees covered by the HCSO in each quarter (SF only)

Total number of HCSO covered employees (and dependents) enrolled in the company’s medical/dental/vision plan in each quarter

Total amount of employer-share of medical/dental/vision plan premium paid for all HCSO covered employees (and dependents) in each quarter

Quarterly city option contributions (number of persons and amount spent)

Quarterly employer HSA contributions for HCSO covered employees (number of persons and amount contributed)

Paid Parental Leave Ordinance survey

Fair Chance Ordinance reporting (related to hiring and employment process for individuals with arrest and conviction records)

Covered employers must meet the following obligations:

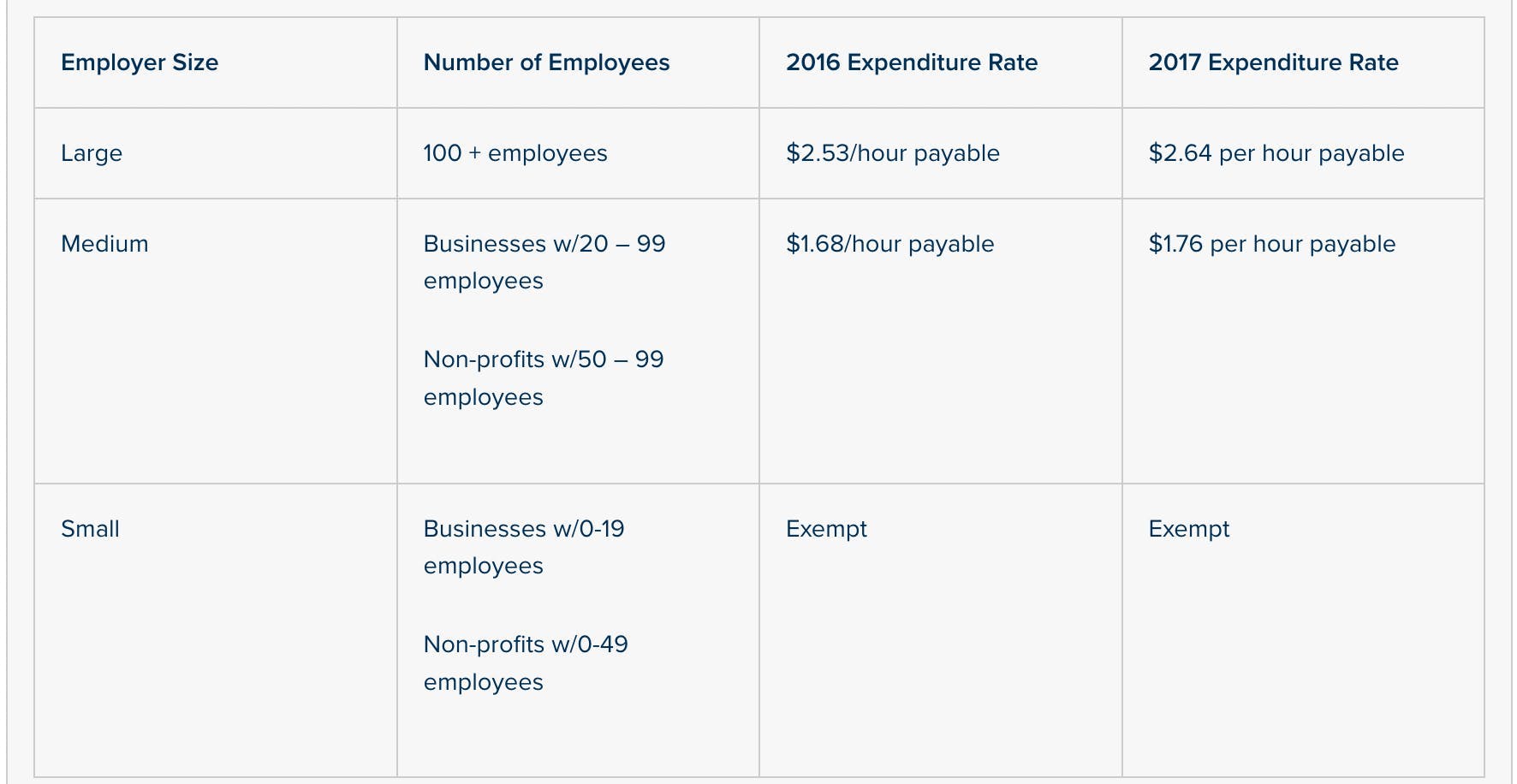

1. Satisfy the Employer Spending Requirement by making required health care expenditures on behalf of all covered employees (generally those who have been employed for more than 90 days, regularly work at least 8 hours per week in San Francisco, and for whom no exception applies) at the following rates:

2. Maintain records sufficient to establish compliance with the employer spending requirement

3. Post an HCSO Notice in all workplaces with covered employees

4. Submit the Annual Reporting form by April 30th each year (May 1, 2017 for 2016).

For more information on all of the HSCO requirements, check out the SF OLSE’s official HSCO website.

Karen Hooper

VP, Senior Compliance Manager

Karen Hooper, CEBS, CMS, Fellow, is a Vice President and Senior Compliance Manager working closely with the Lead Benefit Counsel in Newfront's Employee Benefits division. She works closely with internal staff and clients regarding compliance issues, providing information, education and training.