Health FSA and Dependent Care FSA for Parents

By Brian Gilmore | Published January 18, 2019

Question: When can an employee use the health FSA or dependent care FSA for a parent’s expenses?

Compliance Team Response:

Health FSA for Parents

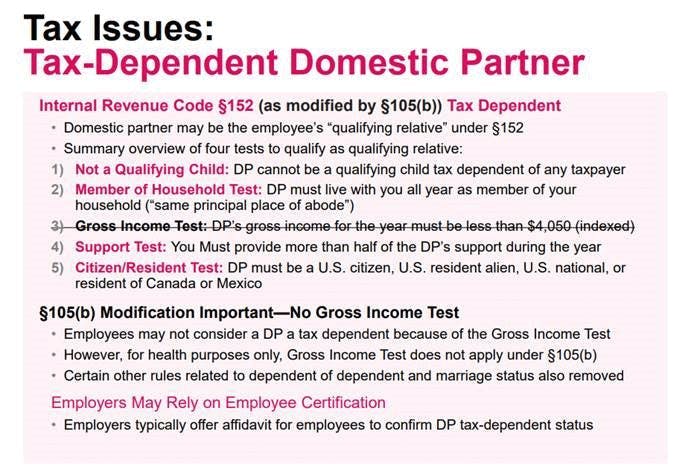

In order to take a distribution from the health FSA for a parent’s medical expenses, the parent must be a tax dependent under IRC §152 (as modified by §105(b)).

This standard generally is the same as the standard tax dependent requirements, with the primary requirements being that the individual live with you all year as a member of your household (“same primary place of abode”) and that you provide more than half of the individual’s support during the year. The primary difference is that the gross income test—limiting the individual’s income to less than $4,200 (2019)—does not apply.

The IRS has a useful summary of these tax dependent requirements for health FSA purposes in Publication 969 (copied below).

Employees should consult with their personal tax advisor to determine whether a parent qualifies as a tax dependent for these purposes.

Dependent Care FSA for Parents

In order to take a distribution from the dependent care FSA for a parent’s dependent care expenses, the parent must be a tax dependent under IRC §152 (as modified by §21(b)(1)(B)) who is a) physically or mentally incapable of caring for himself or herself, and b) has the same principal place of abode as the employee for more than half of the year.

This standard generally requires that the individuals cannot dress, clean, or feed themselves because of physical or mental problems, or the individuals must have constant attention to prevent them from injuring themselves or others. The standard is often summarized as applying where the individual is incapable of self-care.

The IRS has a useful summary of these tax dependent requirements for dependent care FSA purposes in Publication 503 (copied below).

Employees should consult with their personal tax advisor to determine whether a parent qualifies as a tax dependent for these purposes.

Important Note: Parents are Not Eligible for Health Plan Benefits

Tax-dependent status generally is not relevant for determining eligibility for the health plan. It is relevant only for tax purposes and account-based plan (FSA/HSA/HRA) purposes.

Health plans almost uniformly limit eligibility coverage to:

The employee;

Spouse/domestic partner; and

Children under age 26.

(Children generally include natural children, step-children, foster children, adopted children, and children placed with the employee for adoption. Some plans will also extend dependent eligibility to children under age 26 for whom the employee is a legal guardian.)

It is extremely unusual for a health plan to provide for parents as eligible dependents.

See our prior FAST on parents group health plan eligibility.

IRS Publication 969 (Health FSA):

https://www.irs.gov/pub/irs-pdf/p969.pdf

Distributions From an FSA

Qualified medical expenses are those incurred by the following persons.

You and your spouse.

All dependents you claim on your tax return.

Any person you could have claimed as a dependent on your return except that:- The person filed a joint return,

The person had gross income of $4,050 or more, or

You, or your spouse if filing jointly, could be claimed as a dependent on someone else’s 2017 return.

Your child under age 27 at the end of your tax year.

IRS Publication 503 (Dependent Care FSA):

https://www.irs.gov/pub/irs-pdf/p503.pdf

Who is a Qualifying Person?

Your child and dependent care expenses must be for the care of one or more qualifying persons.

A qualifying person is:

Your qualifying child who is your dependent and who was under age 13 when the care was provided (but see Child of divorced or separated parents or parents living apart, later),

Your spouse who wasn’t physically or mentally able to care for himself or herself and lived with you for more than half the year, or

A person who wasn’t physically or mentally able to care for himself or herself, lived with you for more than half the year, and either:- Was your dependent, or

Would have been your dependent except that:

-- He or she received gross income of $4,050 or more,

-- He or she filed a joint return, or

You, or your spouse if filing jointly, could be claimed as a dependent on someone else’s 2017 return.

Physically or mentally not able to care for oneself.

Persons who can’t dress, clean, or feed themselves because of physical or mental problems are considered not able to care for themselves. Also, persons who must have constant attention to prevent them from injuring themselves or others are considered not able to care for themselves.

Do daycare payments for an elderly person qualify for the child and dependent care credit?

Answer:

Daycare payments for an elderly person may qualify as dependent care expenses if the person is incapable of self-care, lives with you for more than one-half of the tax year, and is either your spouse or a dependent. Additional requirements apply if the services are provided outside your household.

Brian Gilmore

Lead Benefits Counsel, VP, Newfront

Brian Gilmore is the Lead Benefits Counsel at Newfront. He assists clients on a wide variety of employee benefits compliance issues. The primary areas of his practice include ERISA, ACA, COBRA, HIPAA, Section 125 Cafeteria Plans, and 401(k) plans. Brian also presents regularly at trade events and in webinars on current hot topics in employee benefits law.

Connect on LinkedIn